Updated – March 2024

Here is the list – These companies are in list as per Market Capitalisation. (Detailed list with important details is listed below)

| S.No. | Name | Market Cap (Rs. Cr.) |

|---|---|---|

| 1. | Life Insurance | 573266.17 |

| 2. | Jio Financial | 218965.94 |

| 3. | SBI Life Insuran | 150316.66 |

| 4. | HDFC AMC | 80556.05 |

| 5. | General Insuranc | 58807.49 |

| 6. | New India Assura | 38291.28 |

| 7. | Nippon Life Ind. | 28264.89 |

| 8. | I D F C | 17663.83 |

| 9. | Lak. Mach. Works | 15456.86 |

| 10. | Mah. Seamless | 11487.77 |

A debt-free company is a company that has zero debt on its balance sheet. Though leverage gives a company the necessary capital to plan and execute its growth, having zero debt on its balance sheet is a sign of strong financials.

A zero debt company has more control over its finances as it doesn’t have an outside loan. Thus, they are fast in execution and more self-reliant in decision-making.

Please note: Just because a company is debt free, doesn’t make it invest worthy on its own. You need to analyze it’s financial health, economic conditions & market growth possibility before investing in a zero debt company.

Economic conditions like availability of funds and rate of interest are factors that play an important role in a company’s growth. When capital is cheap, it doesn’t concern many growth-oriented companies with how much debt there is.

But when conditions are not favorable, it leads to expensive capital. This expensive capital, along with overall economic struggle, makes many people believe that being debt free is a favorable situation for a company. (Which is not exactly the right approach to looking at investments)

Now, before we deep dive into the whole concept of debt-free companies, how to assess and when to invest in them, here is a quick list of top debt-free companies in India

List of Top 10 debt free companies in India – Quick List (March 2024)

To be conservative, the list below is of companies with a large market cap.

Companies that are highlighted in bold are currently good long-term investment picks. Read their detailed analysis in the links provided below.

Also, companies that picked up debt during the last 6 months were removed.

| S.No. | Name | CMP Rs. | Mar Cap Rs.Cr. | ROCEReturn on capital employed (ROCE) is a financial ratio that ... % | ROE % | P/E | Debt Rs.Cr. |

|---|---|---|---|---|---|---|---|

| 1. | Life Insurance | 906.35 | 573266.17 | 148.72 | 129.81 | 14.21 | 0.00 |

| 2. | Jio Financial | 344.65 | 218965.94 | 8709.86 | 0.00 | 0.00 | 0.00 |

| 3. | SBI Life Insuran | 1501.10 | 150316.66 | 15.47 | 13.97 | 80.82 | 0.00 |

| 4. | HDFC AMC | 3773.40 | 80556.05 | 32.31 | 24.47 | 45.23 | 0.00 |

| 5. | General Insuranc | 335.20 | 58807.49 | 20.59 | 16.77 | 9.16 | 0.00 |

| 6. | New India Assura | 232.35 | 38291.28 | 4.87 | 4.07 | 41.17 | 0.00 |

| 7. | Nippon Life Ind. | 448.65 | 28264.89 | 26.64 | 20.68 | 29.37 | 0.00 |

| 8. | I D F C | 110.40 | 17663.83 | -24.42 | -25.30 | 29.46 | 0.00 |

| 9. | Lak. Mach. Works | 14468.65 | 15456.86 | 22.92 | 16.95 | 38.47 | 0.00 |

| 10. | Mah. Seamless | 857.35 | 11487.77 | 19.82 | 17.47 | 10.42 | 0.00 |

| 11. | UTI AMC | 834.60 | 10620.64 | 15.88 | 11.68 | 15.42 | 0.00 |

| 12. | Infibeam Avenues | 35.30 | 9807.66 | 5.53 | 4.09 | 67.57 | 0.00 |

| 13. | National Standar | 4776.60 | 9553.20 | 5.02 | 3.43 | 723.73 | 0.00 |

| 14. | Mah. Scooters | 7060.20 | 8069.81 | 0.92 | 0.93 | 40.34 | 0.00 |

| 15. | JSW Holdings | 7221.95 | 8016.36 | 2.04 | 1.68 | 48.96 | 0.00 |

Short details about top debt free companies in India

HDFC Life Insurance

Established in 2000, HDFC Life is a leading long-term life insurance solutions provider in India, offering a range of individual and group insurance solutions that meet various customer needs such as Protection, Pension, Savings, Investment, Annuity, and Health. (source ~ screener.in)

SBI Life Insurance

SBI Life Insurance is a joint venture between the State Bank of India and BNP Paribas Cardif. SBI Life extensively leverages the State Bank Group relationship as a platform for cross-selling insurance products along with its numerous banking product packages such as housing loans and personal loans (source – moneycontrol.com)

ICICI Prudential Life Insurance

ICICI Prudential Life Insurance Co. carries on the business of providing life insurance, pensions, and health insurance products to individuals and groups. Riders providing additional benefits are offered under some of these products. The business is conducted in participating, non-participating and unit-linked lines of businesses. These products are distributed through individual agents, corporate agents, banks, brokers, the Company’s proprietary sales force, and the Company website. (source)

HDFC Asset Management Company

Read detailed analysis of HDFC AMC – a good long-term investment.

HDFC Asset Management Company was approved to act as the Asset Management Company for HDFC Mutual Fund by the Securities and Exchange Board of India (SEBI) vide its letter dated July 03, 2000. HDFC Trustee Company Limited (the Trustee) has appointed the Company to act as the investment manager of HDFC Mutual Fund. (Source)

Gillette India Ltd.

Gillette India is engaged in the manufacturing and sale of branded packaged fast-moving consumer goods in the grooming, portable power, and oral care businesses. This is a brand with strong visibility and recognition in the Indian market.

Is a debt free company a good investment?

What you need to look for when you are evaluating a company for long-term investing is its profitability and growth factors.

Zero debt on the balance sheet shows that the company is free from financial liabilities, which in most cases means higher profit as compared to any company that has to service its loans.

Due to inflation and interest rates in India, servicing loans from a financial point of view can be a costly affair. Whereas a debt free company is totally free from any such expense or financial planning for spending on interests.

But, the other factor which is the growth factor is something that needs to be analyzed. Sometimes, in their jest to stay debt-free, a company can let go of investing in the future capacity and expansion. This can lead to missing out on the growth of the company.

In such a scenario, the company is good, but from an investment perspective, you don’t have a good option. Hence, you need to look into the company from both these perspectives.

You can also look at the list below to see that, despite zero debt there are considerable variations in returns generated by companies over a span of one year ( and more).

One factor you can look to check the growth factor is an increase in the ‘Total Income’ of the company over time.

Best Stock Screeners for the Indian Stock Market

Should I avoid companies with debt in their books?

No, you should not.

There are many situations when it is not easy for a company to expand without debt. Though this article is about zero debt companies, it is still important to know about something called the debt-to-equity ratio.

The debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More is the ratio between the total debt and the total amount contributed by shareholders (equity).

In the case of a zero debt company, this number is zero. Hence, any number closer to zero indicates a solid self-reliant financial balance sheet.

Something that you can consider for investment by looking at other factors like:

- What is the expected return from the investment of the debt money?

- What is the cost of debt vs expected return?

- Economic conditions can affect the numbers above.

How a company has used the leverage of debt as well as internal cash flows helps to decide about the quality of management and, thus, fundamentals of the company.

Why debt free companies are preferred for investment

Any company with zero net debt on its balance sheet is preferred for investing because:

- Such a company is ‘financially independent from interest rate fluctuations.

- The execution level of such a company is faster than that of other companies that have to keep up with the regulatory restrictions of debtors.

- Any company that has increased net income over time and is still debt-free is ideal for long-term investment as it shows strong fundamentals.

- Moreover, in unicorn cases, the company is cash-positive without any debt because they are leaders in their field and are able to charge a consistent premium on their products. For example, Apple has a famous premium product and its sales have been consistent (or growing) over the last few years.

This also means that you can check if being debt-free was good for them at such times.

Are these companies good for investment at current prices?

With the overall market growth in the last few years, few of these companies are not at fair value compared to their current market prices.

On top of that, as you can see, many of the companies listed above are large-cap. Which is a hindrance to their further growth.

A large company is limited by the overall potential of the market for growth. It already has a good market share, and getting more doesn’t come easily.

Thus a complete analysis is required before investing in any of the companies listed above.

For example, I have analyzed HDFC AMC as a good long-term investment pick. You can read about it in this post.

Moreover, as you can see, 3 companies are from the insurance sector alone, which is not a fair distribution sector-wise.

How to start investing in Stock Market

Companies with manageable debt

Though debt-free is a sign of strong finance, all debt is not bad either.

If a company is using debt in a controlled manner and for taxation benefits, then it shows the sign of business acumen of such companies.

One of the terms used in fundamental research of companies is Debt/Equity Ratio.

It means: Debt on the company/Equity of the company

However, a ratio below 1.5 is considered good. But our aim here is to find companies as good as zero debt companies.

Thus, we can filter our list to companies with a debt/equity ratio below 1.

It means that the overall equity (assets) of the company is more than the debt of that company.

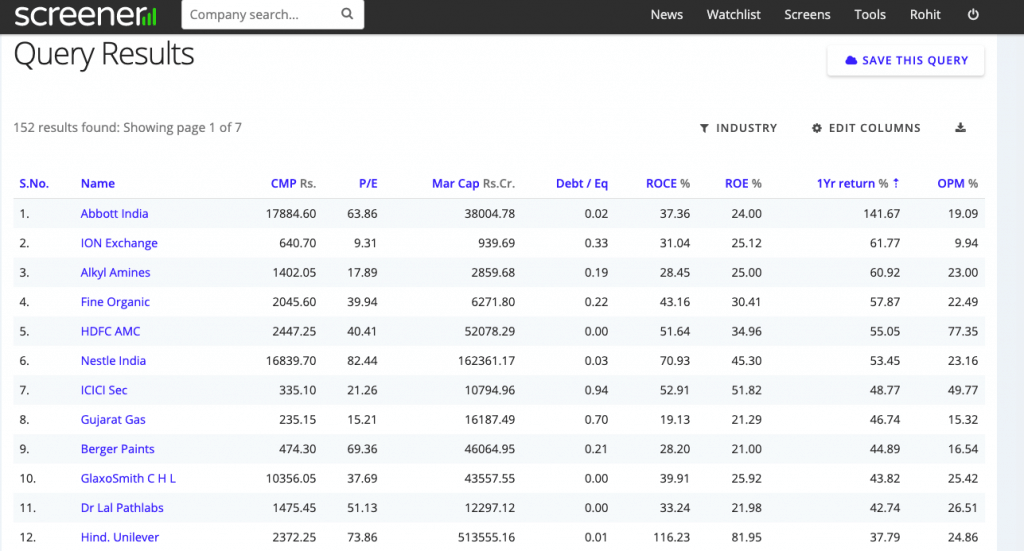

And on top of that, we also use a filter to find stocks with RoE (Return on Equity) of more than 20%, then we have the following set of companies:

The screener used in this query was screener.in

Here is the link to this query

Final thoughts on investing in debt free stocks

A debt-free company is preferred, but that is good only when cash flow is strong.

If a company has zero debt at the cost of growth, you are stuck with the slow-growing company.

Thus, a balance is needed between debt and growth.

The financial strength of a company can be judged by important financial ratios. Along with that, the overall business model needs to be considered when researching a company.

Tags: 0 debt companies in India, debt-free companies in India 2024, debt-free companies in NSE, granules India

Frequently Asked Questions

What are the pros and cons of a debt free company?

A debt-free company has strong financials, no interest payments, and the ability to face economic downturns.

On the other hand, A debt-free company has lower EPS (Earnings per share). This is also because a company without debt is not able to use certain tax benefits.

A good company has low debt, which it can service, and also can take tax benefits to improve overall growth and profitability.

How to find debt free companies in India?

You can use any stock screeners and create a list of companies with zero or little debt.

Screeners like screener.in, equitymaster, moneycontrol have an extensive database to provide this data at the click of a button.

You can also subscribe to our newsletter to receive notifications when we find more companies.

tags: debt-free companies in India, zero-debt companies in India, debt-free companies,

0 debt companies in India

debt-free companies in India 2023

debt-free companies in nse

granules India

Need the 20 good company list for investment for 2 year

Need 10 good companies for investment for 2 years

HDFC AMC, HDFC Life, Gillette are good choices

Informative,systmatic,helpful information.thanks amit

Glad that you liked it, thanks 🙂

How about Reliance and Asian Paints? Aren’t they debt free companies?

Reliance Debt as on March’20 – ₹ 291,417 crores

Asian Paints is ‘virtually debt-free’> https://www.screener.in/company/ASIANPAINT/consolidated/

Thanks for the article. But things have changed in last couple of months for Reliance. Future prospects indicate a growth potential while being debt free. I would like to know how that translates to investibility for Reliance in the long run. Any thoughts? Not looking for stock tips but to understand this peculiar situation for very mega large cap which almost will have monopoly in anything it touches with respect to Indian Economy.

In my experience, Reliance is the biggest company in its current sector and target market (India). And, their next goal along with Facebook and Google will be to include more and more people into digital consumption. Without digital consumption, the services won’t bear financial fruits.

Which means, now that they have the technology and reach, the next step would be to prepare consumers in tier II and tier III as well as rural areas.

How well they will be able to do that, is only time can tell. Having a monopoly alone is of no use unless the buyers are ready to spend more the joint platform, over time.

Good

Want to invest in equities for the first time.with a time horizon of 2/4 years.

Would prefer investing in nifty shares or quality stocks with minimal bedt and good brand. Any suggestions.

If you are investing for the first time, I would suggest starting with companies included in the Nifty 50 index list.

Better will be to start with investing in ETFs, and then start reading more and building your investing skills. Once you gain good knowledge and confidence, slowly start investing directly in shares of good companies.

Need to know list of 20 companies worth investing for double returns within three years.

That won’t be an easy answer. 20 is quite a big number of companies to invest in. Even finding one company takes a lot of research and analysis.

NEED TO BUILD A PORTFOLIO FOR FUTURE

That will require a lot more research than just knowing the debt-free companies.

Sir,An useful article for a new beginner in Trading .

Glad that you liked the article.

Want to do investment in equity from Long Term point of view

Please suggest some good shares for period of 2undefined3 years

Dear sir I'm Solomon from Tamilnadu India please help me I'm very struggling in debt rupees 3 lakhs so humbly requesting you to help me sir.thanking you.

Hi Solomon,

I am sorry to hear about your loss. But you need to understand stock market trading is not an ATM machine. Yes you can make money, but not when you are under the pressure of debt because that effects your trading decisions. I would advise to actually work on something to earn that money, and invest with money that you won’t need for sometime. It takes time for investment to give good returns. Sometimes the returns are early, but that is when market conditions are in favour.

CommentI liked the information

Is it alright to put part of this on my website if I post a reference to this web page?