Introduction

Debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More is one of the most commonly used financial metrics to gauge a company’s financial health. It is a measure of how much debt a company has relative to its equity. It is calculated by dividing a company’s total liabilities by its shareholders’ equity.

By understanding the debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More, you can determine a company’s financial leverage and assess the risk they might pose to its stakeholders. In this article, we will explore the debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More, how it is calculated and interpreted, and its various applications:

Definition of Debt to Equity Ratio

The Debt to Equity RatioIntroduction Debt to equity ratio is one of the most commonl... More (or D/E Ratio) is a measure of a company’s financial leverage calculated by dividing its total liabilities by its shareholders’ equity. This ratio indicates how much creditors and investors are relying on each other to finance the company’s assets or operations. The higher the ratio, the greater the risk of financial distress for a company if it were unable to pay off its debts. It is a key metric used by lenders and investors when assessing potential investments in a business.

The Debt to Equity ratioIntroduction Debt to equity ratio is one of the most commonl... More is often expressed as a percentage and is calculated by dividing total liabilities by shareholders’ equity, with creditors contributing up to 100% of a business’s capital but their money not considered in calculating the debt-to-equity ratio. Equity typically includes common stock, retained earnings, and other items such as accumulated depreciation or miscellaneous accounts.

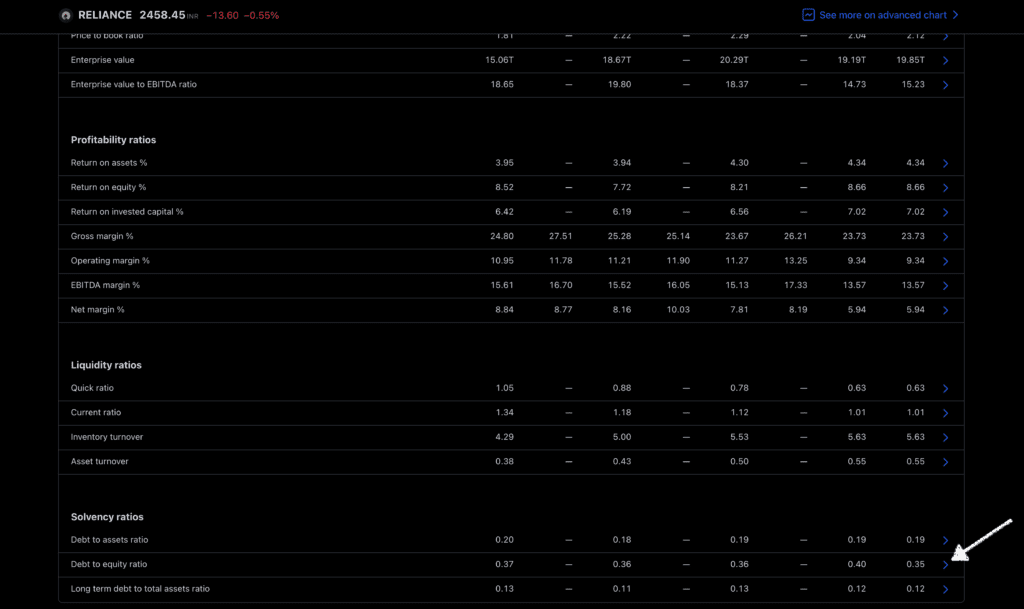

For example here is Reliance Financial data (Jan 2023) – source TradingView

This ratio is typically used in conjunction with a company’s current liabilities such as short-term debt and operational expenses. By comparing these two metrics – Debt/Equity versus Current Liabilities – one can get an indication of what portion of an organization’s debt will be paid for out of income versus out of long term financing sources such as debt instruments or equity offerings. Analysts will often use this metric to assess both the risk level associated with lending or investing in that certain organization and their ability to service future debt payments coming due since they are utilizing existing funds more efficiently than if they had been acquired through borrowing outright from third parties.

Overview of how Debt to Equity Ratio is Calculated

The debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More, also known as the leverage ratio or risk ratio, is used to measure the amount of a company’s total debt compared to its total equity. This ratio determines a company’s financial leveraging and is used by lenders and investors to assess the long-term solvency of a business.

The formula for calculating the debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More is relatively simple:

Debt/Equity = (Total Liabilities/Total Equity)

Total liabilities are comprised of all short-term and long-term debts, including bonds, mortgages and accounts payable. Total equity includes shareholder investments and retained earnings. This calculation can be useful in determining how vulnerable a company might be to creditors if they were unable to meet their payments or refinance their debts.

By comparing the debt/equity ratios of different companies in the same industry, it can become easier to identify trends in both credit risk management practices and levels of investment protection. Companies can also use this information when comparing financing options or evaluating potential mergers between businesses. Ultimately, understanding how this financial reporting tool works will help you better assess how much leeway a business has with regard to loans and investors over time.

Advantages and Disadvantages

The debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More is a financial ratio used to measure the relative proportion of a company’s equity and debt. This ratio provides insight into how much of a company’s capital is provided by lenders and how much is provided by shareholders.

There are various advantages and disadvantages associated with higher and lower debt to equity ratios, and it’s important to understand both in order to make informed decisions about your business:

- Advantages of higher debt to equity ratios

- Disadvantages of higher debt to equity ratios

- Advantages of lower debt to equity ratios

- Disadvantages of lower debt to equity ratios

Advantages of Having a High Debt to Equity Ratio

A high debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More is a reflection of a company’s financial leverage and suggests that the company has been able to borrow extensively. It involves taking on debt or external finance to operate and grow their businesses, while also leveraging their own capital or equity. As long as you can use the borrowed funds responsibly, this can be advantageous in some ways.

A high debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More can make sense for businesses who are managing delicate cash flow situations, such as those that are scaling rapidly. When managed with care, increasing the amount of debt capital through a higher debt/equity ratio can promote growth without sacrificing operating costs. Additionally, because interest payments are tax deductible as operating expenses in most countries, a higher debt-to-equity ratio helps a business to effectively reduce its overall costs in terms of taxes paid.

For those with more established businesses and companies looking for an alternative form financing without issuing stocks or selling bonds, increasing their debt-to-equity ratio can be particularly advantageous. This form of finance allows them to raise money while retaining ownership of their businesses—an important factor when seeking investor funds and offering trust among stakeholders over the long term.

Disadvantages of Having a High Debt to Equity Ratio

When calculating the debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More, a higher ratio usually indicates too much debt and a lower ratio indicates too little. A high debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More may put a strain on the cash flow of the business due to high interest payments for loaned money. This is referred to as financial leverage and can be very risky if not controlled properly.

One of the risks of having a high debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More is that interest must be paid on borrowed funds even if there are times when the company does not make a profit. This can create difficulty for companies when profits are low or non-existent, since they still need to pay off their debt in addition to other operational expenses and taxes. A high Debt-to-Equity ratio often implies that a company has taken on too much risk, making it difficult for them to maintain their current operations and/or distributions, or if needed obtain additional financing through banks or other types of lending institutions.

In addition, debt holders (creditors) have priority over shareholders (owners). This means that creditors would get paid first in case of liquidation (i.e., selling off assets). Shareholders would only receive what’s left after creditors are paid off, which may not necessarily be enough for them to get any money back from their investment in the company. Therefore, having too much debt relative to shareholders’ equity can put shareholders in an undesirable position with lots of risk but little reward associated with it.

Factors Affecting Debt to Equity Ratio

Debt to Equity ratioIntroduction Debt to equity ratio is one of the most commonl... More is a measure of a company’s financial leverage, which reflects the amount of debt and equity used to finance a company’s assets. This ratio is used by lenders and investors to determine the capital structure of a company. Factors such as the amount of debt financing taken, the amount of equity funding and any additional capital investments can all affect a company’s debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More.

Let’s take a look at some of the other factors which can affect this ratio:

Interest Rates

Interest rates can affect a company’s debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More significantly. When interest rates are low, companies are more likely to borrow money in order to finance expansion. This can lead to an increase in the debt portion of the debt-to-equity ratio and a decrease in the company’s equity portion.

When interest rates are high, companies are less likely to borrow money and instead focus on using existing cash sources or generating more revenue through increased sales. These periods typically lead to an increase in the equity portion of the equation which decreases the debt-to-equity ratio.

It is important for companies to be aware of current interest rates in order to manage their debt-to-equity ratio appropriately and make strategic decisions about borrowing or investing funds.

Financial Leverage

A company’s degree of financial leverage can significantly impact its debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More. Leverage is the process of a business using external debt and other financial instruments, such as stocks and bonds, to acquire an asset or expand the business. Businesses use financial leverage to reduce their risk exposure while still gaining a return on their investments. As such, businesses that use more leverage will have larger amounts of liabilities compared to equity and thus higher debt to equity ratios.

Financial leverage encompasses two types: operating leverage and financial leverage. Operating leverage is when a business uses fixed operating costs and variable inputs in order to increase profits, such as using software and automation instead of manual labor for production processes. Financial leverage often involves taking out loans for longer-term investments in the form of dividends, preferred stocks, bonds or any similar security that provides fixed returns over a particular period of time.

On the other hand, when businesses use less financial or operational leverages their debts decrease in comparison to their assets resulting in lower debt/equity ratios. Therefore, it is important for businesses considering expanding through leveraging sources other than retained income savings balance sheets should assess both the risks and rewards prior to taking on this type of risk exposure associated with it.

Risk Tolerance

Risk tolerance is an important factor when it comes to determining a company’s debt-to-equity ratio. An investor’s risk tolerance will influence the amount of debt they are willing to take on as well as the type of assets they may choose to invest in. Companies with lower risk tolerances will prefer to have a lower debt-to-equity ratio, which means that they prefer to finance business activities through equity rather than debt. On the other hand, those with higher risk tolerances may be more likely to take on additional debt in order to finance expansions and acquisitions.

The level of risk individual investors can tolerate depends on their current financial situation and their long term goals. For instance, those who are using borrowed money in order to buy a home may prefer to keep their debt-to-equity ratio low because they want low monthly payments and a longer repayment period. Others who are expecting retirement soon or who need cash for medical bills may want higher levels of leverage, since the interest expense can be deductible on taxes and they expect their income or investment returns to cover the costs of service later.

The amount of leverage an investor or company is willing or able to take on also depends on factors such as available credit lines, projected profits, and current asset values versus liabilities. As such, understanding one’s own individual financial situation is essential when evaluating different levels of leveraged investments so that proper decisions can be made about managing one’s own personal finances and/or adding additional sources of financing into a business portfolio.

Conclusion

Debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More calculation is a crucial financial assessment tool to measure companies’ financial health and stability. It helps companies assess their risk and assists investors in making informed decisions. By considering a company’s debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More, investors can quickly identify whether or not a company is overleveraged or has too much debt.

Furthermore, a company’s debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More can provide a measure of the company’s long-term financial goals and sustainability.

Summary of Key Points

The Debt to Equity ratioIntroduction Debt to equity ratio is one of the most commonl... More is an important measure of a company’s financial health, as it provides a snapshot of the amount of leverage being used by the firm. It is calculated by dividing total liabilities by total shareholders’ equity. A lower debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More indicates that a company has less leverage and is better able to finance its operations. However, a ratio that is too low can also be an indication that a company is not taking full advantage of available financing options. A debt to equity ratioIntroduction Debt to equity ratio is one of the most commonl... More that is higher than average may be seen as an indication of greater risk and could be an indication that the company could have difficulty financing its operations in the future if profits decline or other events occur which reduce cash flow.

It is also important to look at other information related to the debt-to-equity ratio when analyzing a company’s financial health, such as:

- the type of debt (long-term or short-term) and the interest rate associated with each type of debt.

- other financial ratios such as return on assets (ROA), return on equity (ROE), and liquidity ratios which can also provide helpful insight into a company’s overall financial standing.

Ultimately, it is important for investors and business owners alike to understand how Debt/Equity ratios impact their business and make informed decisions about their businesses’ financing strategies going forward.