In the Indian stock market alone, there are more than 3000 companies listed at NSE & BSE. Unless you are a full-time investor or trader, you don’t have enough time to keep an eye on all of them. This is extremely difficult for even full-time market professionals.

On top of that, the amount of data is only increasing. Earning reports, trading volume, Price movements, Policy matters, what not? A visit to the equity section of NSE can give you a good idea about a small part of the data pertaining to stocks

This is where a stock screener comes into the picture. This tool helps you to filter stocks based on your filters. Thus, using a screener, you can filter out a list of companies that meet your defined criteria.

A stock screener is a must-have tool for both investors & traders.

What is a Stock Screener?

A share or stock screener is a website designed to help you screen stocks based on filters. These easy to use options, reduce the manual task of going through data to a few seconds.

For example, let’s say you are researching companies of particular Debt/Equity Ratios. You simply select create a filter for such criteria and screen out the companies which fulfill that criteria.

Why stock screener is useful for investors

A screener is a popular tool among long investors. Whatever your investing philosophy, there are certain parameters that are important to that philosophy. This is where this tool is useful.

These factors can be the minimum market cap of the stock, certain ROI (Return on Investment), a certain number of quarters in profit or any of the many other combinations. Each such parameter that you use to scan stocks is a filter.

For example, let’s say you want to find stocks with:

- Zero Debt or Low Debt to Equity RatioIntroduction Debt to equity ratio is one of the most commonl... More (less than 1)

- RoE > 20%

- Market Capitalization above ₹ 500 crores.

On your own, it will be a difficult task to go through so many annual and quarterly reports and then crunching this data yourself.

Whereas, when you use a stock screener, you can get this data within a few moments. Without any manual calculation.

You can also save such list and to use it later for further research.

You can also set up alerts for your conditions, the stock screener website will send you an alert whenever your conditions are met.

Best Stock screeners for Indian Market

Each one of the websites listed here is providing a competitive service. Each platform provides an exhaustive list of features in their service. So much so that it can be confusing at times.

The good thing is nearly all of them provide certain features free of cost. In most cases, free features are sufficient.

3 Best Stock Screeners for Fundamental Analysis – Investors

The list is in no particular order:

Screener.in

This one is also one of my favorites. Simple, clean interface. An exhaustive list of features. On top of that, it provides the most features within the free version.

In screener.in you can either search for a company directly or you can create a query for creating a list of companies that fulfill your criterias.

You can also save the list (called screens) & set alerts for the same.

Here is a quick list of features (free version):

- Create Custom Stock Screens

- You can create a watchlist of 50 Companies

- Customized export to Excel feature

- 2 Screen alerts

- Create custom ratios (for advanced users)

Screener.in has a premium part as a paid plan. The charges are ₹ 4,999 (GST included) – which in my personal opinion are a little high for a retail investor. Though for a research analyst, it makes sense. Or you can share it with a friend or two.

Their free features are good enough for fundamental analysis of stocks.

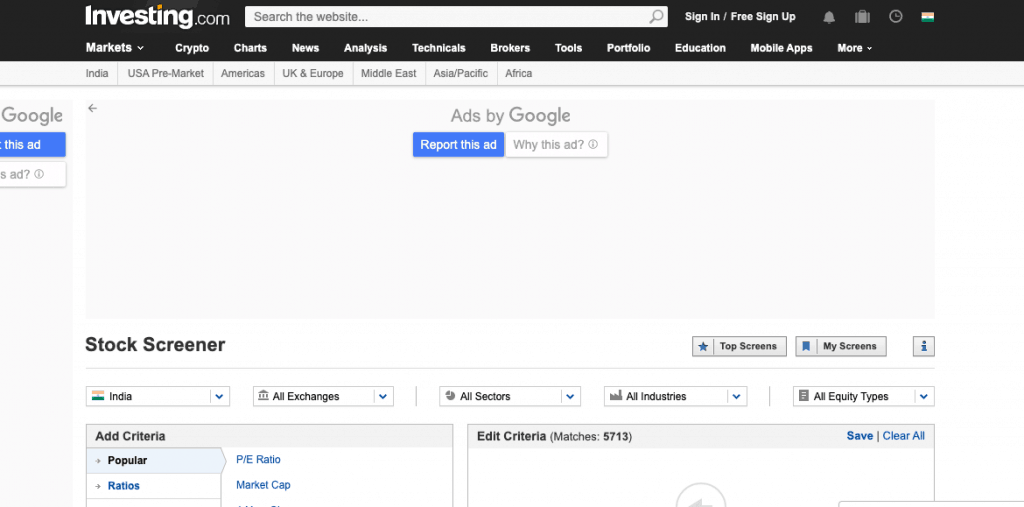

Stock Screener by Investing

Investing.com is one of the biggest websites worldwide and they provide a good stock screener.

One of the main factor here is that you can actually select the sector/industry that you want to focus on. You select the sector and then you can define other filters to scan companies within that sector only.

Here is a list of features of investing.com screener:

- One of the best features is that you can set as many free alerts are you like.

- You can download results and analyze them offline.

- You can save your favorite screeners for future use.

Along with their chart facility and alert facility, they are one of the top screeners for technical analysis of stocks too.

Removed: Screener by Smallcase

Smallcase has removed its screener facility and has moved over to paid thematic investment services only.

Smallcase is a Rainmatter backed company. This fintech company came up with the idea of simplifying investments by providing thematic investment services. The screener is an additional independent service offered by Smallcase.

Being a fintech company has its own benefits. One thing is the smoothness of the website and the service itself:

Bonus stock screener for in depth analysis

Both Screener.in and investing.com based screeners are very good to give you list of stock that fulfill certain criteria. This ability to give you list of stocks is what puts them on the top.

Whereas there are a couple of stock screeners more which are very good for fundamental analysis of stocks. The only problem is that you need to put in the name of the company to find more information.

Here is the list of stock screeners, for in depth research on companies:

Moneyworks4me.com

This tool gives complete analysis of the selected stock. It has paid feature to provide ready made fundamental research of the companies.

If you know how to research, then the free details provided by this tool is good enough:

- Complete tabulated information about past performance of the company from financial perspectives.

- Corporate Governance X-Ray to highlight important factors.

- Paid feature to show the right price to buy the stock – from Value investing perspective.

3 Best Stock Screeners for Technical Analysis – Traders

Now, investors are not the only one who benefit from stock screeners. Traders ( who mainly trade in cash segment) also use stock screeners to filter our stocks based on technical parameters.

Below mentioned stock screeners are designed with stock traders as primary visitors

Fyers One

This one got referred to me by two different traders. To be clear this is more of trading oriented desktop software. Competing in the already competitive market of discount brokers, Fyers is putting the best of market features in the software. And, it shows.

The interface is clean, easy to understand and works well. We didn’t face any glitch with the backend for the duration of our testing.

Though most of my interest lies in investing now, time to time I like to trade in short to medium term opportunities. I use proper technical analysis tools like this trading platform for scanning such opportunities. I found Fyers One to be quite good for such use.

Chatink.in

This is a technical analysis website, through and through.

The interface is quite loaded. And to any newbie, it will feel overwhelming. Especially, the ‘today’s top trending scans’.

But once you get used to it, this is quite a fascinating website. Again, loads of data. Very exhaustive.

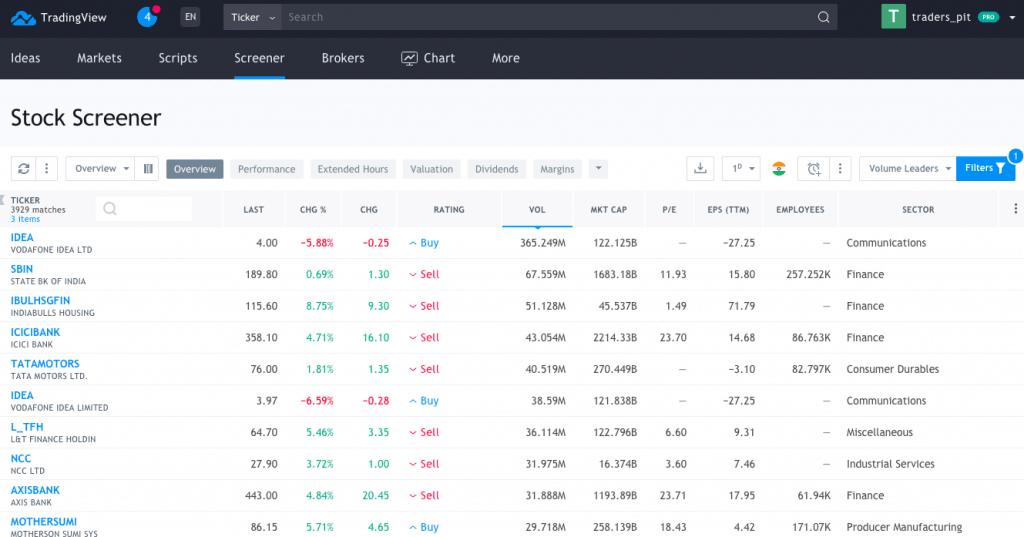

TradingView-Screener

TradingView is currently one of biggest charting website in world.

Their charts are so good that brokers like Zerodha, provide the charting option of self or trading view charts. Crypto exchanges also give the same options.

They are my choice of independent chart service providers. And one their stock screener as you can see is quite easy and fast to use.

How to use a screener for maximum benefit

Just remember one thing. A stock screener is just a tool.

Just like all the other tools, you will use to improve your investing ( and trading skills).

Tools are not your decision-makers. That is something you decide on your own.

Let’s see how to best use a screener as an investor.

Decide your important basic filters for getting a list of good companies, like good RoE, RoI, Debt/Equity Ratio, Market Capitalization, etc.

You will get a list of financially stable companies. From, here you have to deep dive into each company separately.

Once you have decided upon a good investment choice, you can now set an alert for that company. The alert can be with regards to price, important announcements from management, and other things.

Within screener you can save your list and get it updated as quarterly and annual financial reports are released by companies.

Hello.This post was extremely remarkable, especially because I was searching for thoughts on this matter last Monday.

Glad that you liked it, thanks 🙂

Excellent article! You did a fantastic job on this topic, Really impressive! May I add one more productivity tip to your list if you don’t mind?

A website that has many pre-made scans like OHL Scans, ORB Scans, and NR4 NR7 Scanner which help you to select the best stocks for trading including next-day stocks. So in my view, you can also add the Intraday screener.