When you are learning about stock market, one of the first stock market terms that comes into the picture is trading account.

And then the next obvious question – What is the difference between trading account and demat account?

First let’s understand about trading account and then you can read about demat account in this post

What is a trading account

A trading account is transaction account provided by your broker or broking arm of your bank to transact in share market.

You need a trading account to buy or sell shares in stock market. Because a licence is required to access the stock market.

You need to have broker’s licence to operate in stock market. Which is a complete operation in itself, so retail investors, traders and other institutional participants open a trading account with any of the registered broker.

This trading account provide you access to share market through your brokers.

Only thing that you hold in your trading account is either the margin money or your current positions.

The shares you buy to invest are transferred to your demat account, which is a different purpose account.

Documents required for opening trading account

Similar to demat account, a trading account also require following documents:

- PAN Card

- Address Proof

- Bank Statement

- Passport size photograph

- Cancelled Cheque

Along with this, most of brokers ask for a cheque with some margin amount (rather then cancelled cheque) to open your account. This can range anywhere from Rs. 1,000/- to Rs. 10,000 /-. It is not a fixed and can be bargained with.

Currently, if you are opening account with Upstox or Zerodha, then these charges are waived off and trading account is free of cost.

When do you need a trading account?

You need a trading account to buy & sell shares in the secondary stock market. The secondary stock market is:

The secondary market is where investors buy and sell securities they already own. It is what most people typically think of as the “stock market,” though stocks are also sold on the primary market when they are first issued. ~Investopedia

So, if you planning to invest in stock market on your own. Long term or short term, that is when you need a trading account.

For buying Mutual Funds, IPOs etc. you don’t need a trading account.

Why do you need this account?

As you know by now, a trading account gives you access to secondary market.

Which means, the IPO stocks which you invested in, when they need to be sold, you need access to the secondary market. And access to secondary market is through trading account.

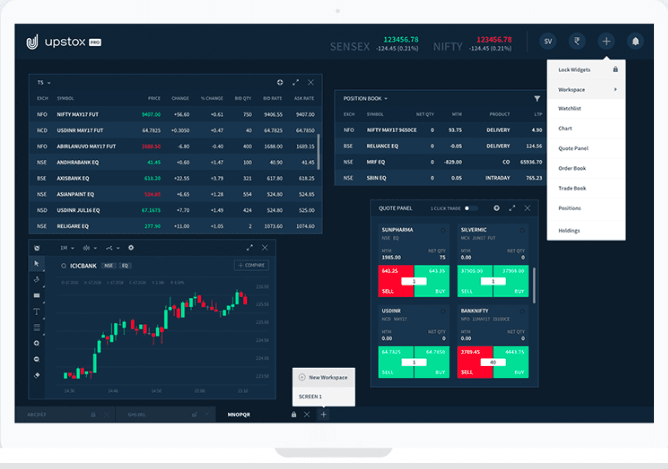

The main benefit is the seamless access that you get to your own demat account as well as the share market on one terminal. With a trading account, you can access both electronically. Thus automating a lot of your investment and earning money from stock market via trading needs.

The other benefit is access to broker provided research reports, real-time stock quotes and trending stocks. This knowledge is very useful in building your financial future.

So in summation

Benefits of opening a trading account

- Access to demat held shares & stock market from single platform.

- You can check your portfolio on a computer as well as on your mobile through broker’s app.

- Access to research reports, financial data provided by your broker

- Charting facilities provided by nearly all the brokers these days. With technical analysis, you can see the trend and enter the market when prices are dirt cheap.

If you are yet to open a trading account, I suggest you do that soon. It is a good tool to help you in reaching your financial goals and build wealth.

Frequently Asked Questions

Which trading account is best in India?

All the popular brokers like Zerodha, Upstox, 5Paisa, Fyers etc. provide good service and competitive brokerage.

In last couple of years they have improved their trading account facilities a lot. If you need technically inclined platform, then Zerodha, Upstox & Fyers have leading tech trading platforms.

Personally, I have used Zerodha, Upstox, Angel, Motilal Oswal & Geojit.

How many trading accounts a person can have?

A person can have as many trading accounts as he likes. There is no limit to number of trading accounts you can have.

The only issue is managing so many trading accounts. Most of the traders have 2-3 trading accounts as backup to each other.

For investing purposes, 1 trading account is good enough.

Do you need a trading account when you have a demat account?

A trading account is different from a demat account. A demat account is for holding your securities in electronic format like a bank holds you money.

Whereas a trading account is for transaction in stock market. You can buy and sell shares only through a trading account.

Can NRI open trading account in India?

Yes, NRI can open trading account in India. The procedure is slightly different as compared to a resident Indian.

A NRI has to open his trading with a broker authorized by the RBI. They must avail either a Non-Resident Ordinary (NRO) or Non-Resident External (NRE) account to route the various investments.

Such investments can be made under the Portfolio Investment NRI Scheme (PINS) either on repatriation or non-repatriation basis.

Please contact a designated broker for more details.

With more than 12 years of experience in the market, I have tested many brokers. You can find mine, as well as my fellow trader’s reviews about brokers in the review section.