In 2019, a rare situation happened in Indian Stock market. While the leading market index, Nifty, made new high, many stocks were trading at 52 week low prices.

Index funds vs mutual funds, when considered in light of many years of data shows that a well managed mutual fund will almost definitely perform better than index funds. Though, this was not so good in 2019 in Indian Stock Market.

Which means in many cases, in 2019, Actively managed mutual funds gave returns which were either equal to or below the returns given by Index funds.

And as mentioned by a news article, Warren Buffet said, “Index funds provide good investment choices.”

So, when you compared index funds vs mutual funds, which one should you choose?

What does the data say about it? What are the returns so far?

The answer is not as easy as it seems. Let’s have a look at the data:

Index Funds vs Mutual Funds: The basic difference

Index funds are funds which have their portfolio designed as copy of the index they follow. A nifty based index fund will have shares in exact same proportion as the Nifty itself.

Read: What are Index funds

Whereas, a mutual fund in general sense has portfolio designed by the fund manager of the fund. The fund manager has a team of research analysts to analyse the investments.

Thus, it is active management of funds and supposed to generate greater return as compared to an index fund.

But, in reality, it depends a lot on the performance of the fund manager. As you can see from the following data, stock selection skills of the fund manager can create big difference in the returns of the fund.

Index Funds vs Mutual Funds: Comparison of returns

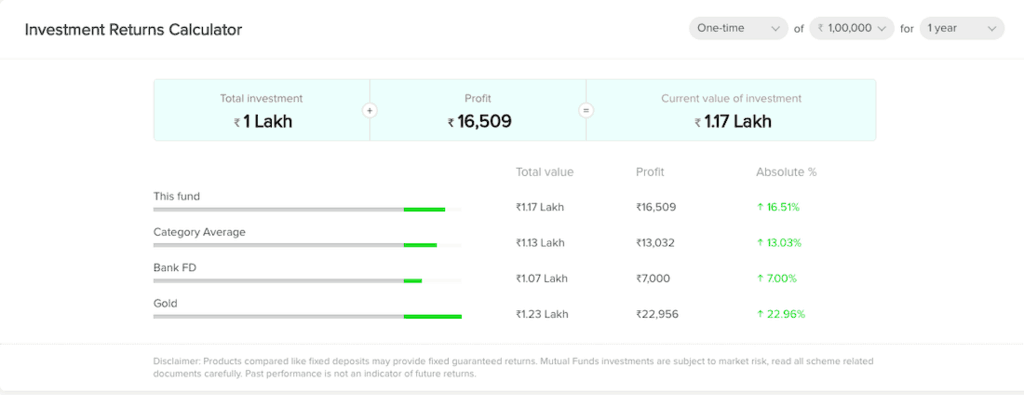

Index Fund returns:

For analysing the returns of Index Funds in India, we checked the returns of top rated Index fund for last 1 year and as well as last 5 years.

This way you get a clearer picture, because the time frame is right in the middle of highly volatile market movements of the year.

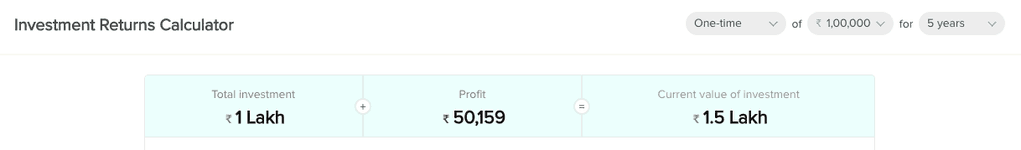

Here is the return over the span of last 1 year (HDFC Index Sensex Fund):

Here is the return of last 5 year of same fund (the return is in cumulative percentage)

Mutual Fund returns:

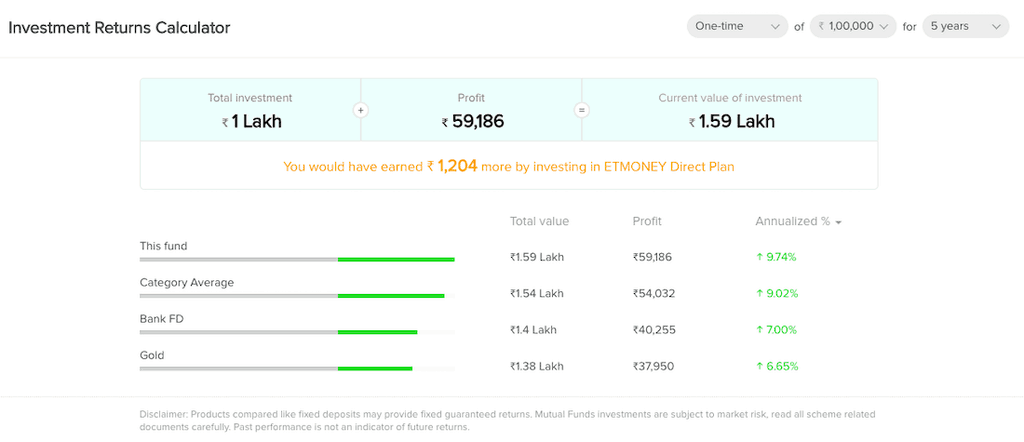

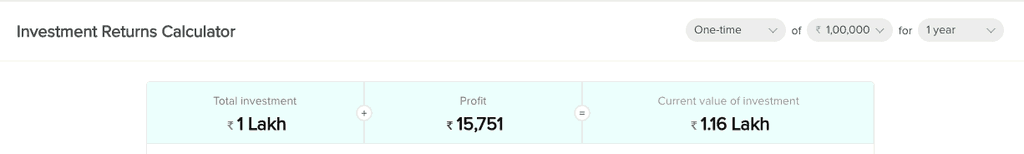

HDFC Top 100 – Direct Fund

Returns over period of 1 year and 5 years

As you can see, this mutual fund has not returned any extra return as compared to the index fund mentioned above.

Now considering that HDFC Top 100 is one of top rated large cap fund in India, the return being nearly equal to Index fund (with lower expense ratio) shows Index fund as better option.

Herein lies the difference of choosing right Mutual fund to invest into. Let’s look at other fund, that invests only in large cap too.

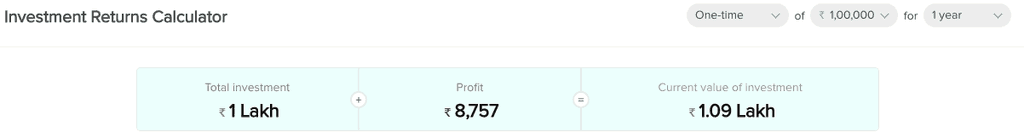

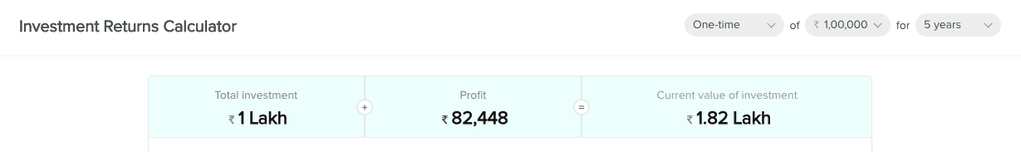

Mirae Asset Large Cap Fund

Look at that, a return which is around 60% more than the index fund or nearest top performing fund.

And this return is over span of last 5 years, not of last 1 year.

This difference also highlights the benefit of researching about mutual funds before investing in them.

Warrent Buffet statement about index funds

This popular statement was made in year 2007. But just to be clear, this was not made against mutual funds, but as compared to hedge funds.

Here is the details of the bet as reported in Fortune Magazine

So, what makes it different in case of India.

In India, there are no hedge funds. What we have are mutual funds.

Mutual funds that we have are part of regulated market. Thus, they have operate within their regulated structure.

Every mutual fund clearly states the investment philosophy and assets that it will invest into. This philosophy doesn’t change over the life of the fund.

Which means, there are regulations and checks and balances, which insure that the fund manager will invest only in options which are according to the fund documents.

Thus, all you need to do is research a good quality fund of right investment philosophy and you can be sure that there is no mismatch in your investing vision.

Final thoughts on Index funds vs mutual funds debate

One concept that helps in all kind of risk profile is a well balanced portfolio. A heavily biased portfolio exposes you to unnecessary risk.

Hence, I have found and advise to keep at least one index fund in your portfolio. This gives your freedom to invest in other thematic funds too.

Whereas, in index funds vs mutual funds comparison, mutual funds do perform better overall.