For investing in Mutual Funds, one of important terms that you need to know about is expense ratio.

What is expense ratio?

Expense Ratio is fee (in percentage) that every fund charges from your fund, when you invest in the fund. This fee is used to cover administrative and marketing expenses of the fund.

For example, if the expense ratio of any fund is 2% and you invest 10,000 in SIP in that fund. Then out of every SIP, fund will deduct ₹ 200/- and will invest ₹ 9800/- into the units of the fund.

Basically, this is the way that mutual funds earn.

One aspect of this fee is used to cover the expenses the fund house has with relation to fund manager, researchers, analysts of the team and other admin expenses.

The other aspect this fee is used to pay commission to distributors and brokers who bring investors to the fund. Thus, when you invest in the fund via your financial advisor, bank etc, they get paid certain percentage as commission.

Why commission is/was paid to the intermediary?

Till very recent times, there was no easy way to invest in mutuals funds.

You were required to get the details about the fund to invest in, get the paperwork, fill it and send it back to the fund’s office for processing.

This part was done by the intermediary like your bank relationship manager, financial advisor, even you CA. Thus, they were paid for the work hours they are putting in to get the paperwork done.

For this work (and as an incentive to sell that fund), these intermediary were paid anywhere from 0.5% to 1.5% of commission on invested amount.

This amount comes from the expense ratio you pay to the fund house.

But this is not the case anymore and hence changes are being introduced in the expense ratio structure of the mutual funds.

These days all you need is to install an app or login via website to invest in mutual funds.

How to save on expense ratio

The good news is that now with little work on your part you can actually save a good part of these expense ratio.

Market regulator, SEBI has issued several notifications over last few years to bring transparency and lower expense ratio in mutual funds industry.

One of the most important step in this direction was introduction of Direct Mutual Funds.

Direct Mutual Funds are same Mutual funds ( Regular Funds). It’s just another way to investing in same mutual fund (and save money while doing so).

The only difference is expense ratio charged in direct route vs regular route into the same fund.

When you chose to invest via direct route, no commission paid out to any intermediary. Which means the same amount is actually invested in fund units for you.

In simple calculation it means an extra saving(or investing) of approximately 1% with each SIP.

Add that to more than 10-15-20-25 years of investing that you are planning to do and it adds up to a sizeable number.

Here is the current difference in expense ratio charged for same scheme in both Direct route and Regular route:

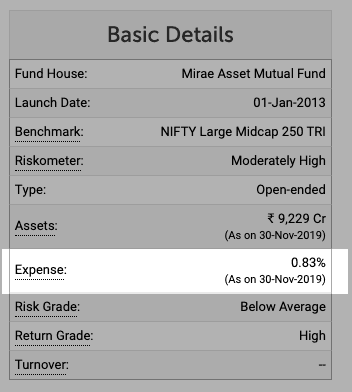

Mirae Asset – Emerging Bluechip Fund – Direct Plan:

Mirae Asset – Emerging Bluechip Fund – Regular Plan:

A difference of nearly 1% for investing in same fund.

How to use expense ratio to correctly measure returns of a fund

Now, expense ratio is important factor not only with regards to direct and regular plans of mutuals funds.

It is also an important factor when you are comparing different funds for investing purpose.

The reason is that there is only an upper cap (recently introduced by SEBI) with regards to expense ratio that a fund can charge.

Which means funds are free to charge the expense ratio for their funds upto the upper cap.

This means different funds are charging different administrative fee. And thus, when you are comparing mutual funds for returns, you need to look at their expense ratio also.

For example, here are two midcap funds with their last 1 year return being nearly equal .

Axis Midcap Fund – Direct Plan (13.8%) & DSP Midcap Fund – Direct Plan (13.17%)

And here is the look at the expense ratio charged by both funds:

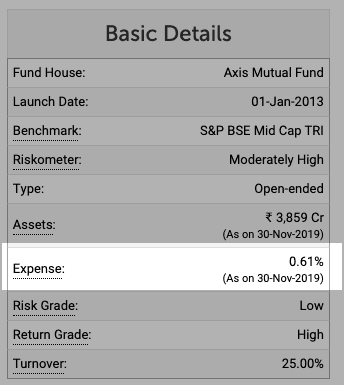

Axis Midcap Fund – Direct Plan:

DSP Midcap Fund – Direct Plan

Nearly double!!

Which means when you are comparing their returns, you need to subtract this additional fee being charged.

Once you subtract this number, you get a clear picture about which fund has performed better.

But, just to be clear, Expense ration is just one of many other important factors that you need to consider when analysing mutual funds for investments.

Frequently asked questions:

Where to find expense ratio of mutual funds?

All the popular mutual fund investing website and apps provide the fund information including expense ratio. You can visit etmoney, valuersearchonline, moneycontrol to find the expense ratio of any mutual fund.

You can also find the expense ratio of any mutual fund on that AMCs website.

What expense ratio is good in mutual funds?

There is no clear answer to that. Expense ratio are generally lowest in direct index funds and highest in regular equity plans.

Higher expense ratio is not automatically better. You need to compare the result of two equally performing funds and deduct the expense ratio from the returns. The ratio being charged should be justified with returns produced.

When is expense ratio charged in mutual funds?

They are charged daily. The daily NAV of any fund is calculated and listed for the day after deducting all the fees and charges.

Thus, the deduction of ratio is done on daily basis.

Why does expense ratio matter?

How much ratio is mentioned and deducted from a mutual fund scheme can effect the return of both regular and direct fund.

To calculate the real rate of return of any fund, you deduct the ratio charged on that fund.

Press the bell icon on right side to subscribe and receive notification about latest posts and quizzes and giveaways.