Important stock market terms for traders & investors:

Whether you are a beginner trader or an investor, there are certain stock market terms that you need to know. The reason is you will see them many times across all the sources.

These stock market terminologies will help you a lot in learning about the market.

[thrive_leads id=’946′]

Let’s get started:

What is share market?

A share market is where stock buyers and sellers connect.

It is also the place where companies offer their shares to public in return of people’s investments.

India’s two biggest stock markets are – National stock exchange (NSE) and Bombay stock exchange (BSE).

32 Important stock market terms that you should know

Share

A company’s ownership can be divided into equal units so that different people/lega entities can own the company by owning these units separately. These units are called as shares of that company.

A person’s (or legal entitie’s) ownership on company is equal to number of share units owned by them.

Shareholder

When any individual or legal entity owns the share of a company, they are called as shareholder of that company.

Shareholder has a claim of ownership on the company. This claim is dependent on number of shares held by you.

Index

Once you know about share market, then Index is one of the first stock market terms that you will read or hear about.

Index is a measuring tool. It is calculated from the prices of selected stocks which are part of index.

It helps traders & investors to know current state of the market by comparing current value of index to past values.

IPO

Initial Public Offering or IPO for short is the process with which any private company offer shares to general public. The company offers shares to raise capital from public.

Once the IPO is done, the company is listed on stock exchange and people can buy and sell shares of that company in the secondary market.

Primary Market

Primay market is that part of stock exchange where new securities are created. When a new company enters stock market through IPO, it is done in primary market.

Here investors buy securities directly from the company offering them.

Secondary Market

Once a stock or security is launched in primary market, it is available for buying and selling in secondary market.

Here the main activities of buying and selling happens between traders and investors.

Blue Chip Stocks

Blue chip stocks are those stocks which are leaders in their sector as well as overall in the market.

Like, Infosys is a blue chip stock in software companies. SBI is a blue chip stock in banking sector. HDFC Bank is a blue chip stock in banking sector.

Annual Report

Annual report is a financial statement prepared by all the listed companies for the shareholders.

This report contains details about the operational, financials of the company in last year. It also shows the future plans of the company through notes from management.

When you are analysing a company for investment, annual report is again one the first stock market terms that you encounter.

Broker

As an individual you can’t directly participate in the stock market. You have to go through market intermediaries who are registered with sock exchanges. These are called as share brokers.

These share brokers act on your behalf, in the stock market.

Demat Account

Demat account is like an electronic account in which the shares you buy are transferred in electronic form. Functionally it is similar to a bank account.

Functionally it is similar to a bank account.

Read: Everything you need to know about demat account

Trading account

When you want to buy or sell share in the share market you can do it only through your trading account. Your trading account is with your broker.

Read: Trading Account — What you need to know

Dividend

When you are shareholder of a company and that company decides to share a part of profit among shareholders. Then as shareholder you receive a part of that profit as equivalent of your shareholding.

The money that you receive as shareholder in such case is called as dividend

Sector

In stock market terms, sectors are different categories of businesses.

Like banks are from banking sector, software companies are from IT sector and so on.

Portfolio

The collection of all the stocks and other securities owned by you is called as portfolio.

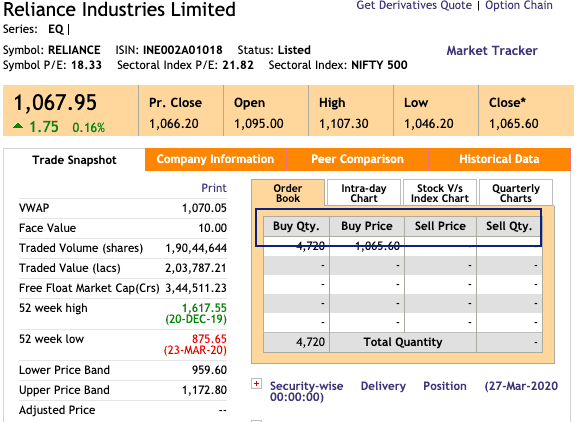

Bid Price

Bid price is the price that the buyer offers to pay for buying a unit of security.

It is also called as buy price when you check it out on exchange website:

Ask Price

On the opposite direction of bid price, ask price is the lowest price that a seller of a share is ready to sell a share for. It is also referred as sell price.

LTP

LTP means last traded price it is the price at which the last transaction of the stock has happened.

In the image above, 1067.95 is the LTP of Reliance industries share.

Limit order

Limit order is that order in which you put the price of buying or selling a share.

Market order

Market order is an order in which use sale or purchase the shared the best available price site at that point of time.

Bull market

Its is that phase of the stock market in which the prices of the index is going up for some duration.

Bear Market

Bear market is that phase of the market in which the stock prices are actually going down.

Going long

When you purchase a share for the purpose at the price will increase in near term is called as going down.

Going short

Going short means to sell any stock so that you can buy it later at a lower price. This is done to earn profit from the following price of the share.

Day trading

Day trading or intraday trading is when you buy or sell a share and then close your position within that day.

Stocks which are in news, have more than usual movement in their prices. Intraday trading is done by traders to take the benefit of price movement of the stock.

Margin trading

Margin trading is when a trader use borrowed funds (provided by broker) to buy or sell stocks.

This facility is provided for very short time — usually for intraday.

Volatility

Volatility indicates how fast a share goes up and down in a day. Higher the volatility moment that stock will show in a trading day.

Volume

It shows the average number of shares of a stock that were trading during a given time frame. It is usually measured in daily volume.

Liquidity

Liquidity denotes how fast or easily you can sell or buy a share without change in the price.

Equity

Equity segment of stock market is where shares of a stock are purchased and sold in cash. When you trade in equities, you buy or sell based on what you have in your trading and demat account.

When you buy shares as investor, you trade in equity of that stock.

Delivery

When you buy shares, you don’t immediately get them in your demat account. They are first collected from the seller and the delivered to your demat account.

In India, the delivery of shares is T+2, which means you get them 2 days after buying them in the stock market.

Derivative

In this market, there is no actual delivery of shares of a stock. All the buying and selling here is done to take the benefit of movement of prices of stocks and indexes.

Th derivative market is for traders and hedging by big funds.

Expiry

This term is related to Futures & Options Segment (F&O). Every instrument in F&O segment has a time based validity.

This validity is decided by the Exchange and that date is called as expiry. Usually it is last Thursday of the month for monthly instruments.

Tags — Share market terms, stock market terms, stock market terminology, share market terminologies

buying long and selling short is only a methodology of trading by ourselves right. Or will there be any specific provisions in trading account for that?

Sorry if the question is too stupid. I'm just a Novice in equity market.

In trading account, you only have two options – buy and selling. When you do that is up to you, as a trader. Trading account by different brokers is only facilitators of this thing only – buying and selling. Every other tool provided by brokers is to the trader decide better or to make the buying and selling easy & faster.

Hi,

That’s an absolutely genuine question. My mistake to reply after so long. Yes, buying long and selling short is method of trading by ourselves. There is no special provision in trading account for that. Though, for trading in futures and options, you need to get that segment activated in your trading account.

I have already opened Demat and Trading Accounts but still do'nt understand how to start. What should be my first step for buying stocks and how to select them?

As an absolute beginner, I will suggest to first spend time on learning about the company that you find as a recommendation. Few simple things like understanding the ROCE, Debt/Equity ratio of that company are good enough indicator to tell you if that company is good long term investment candidate or not.

Please don’t start investing directly in equities without understanding and learning about what you are investing into.