Moneybhai is virtual trading simulator by Moneycontrol.com. Currently, it is one of the biggest virtual trading platform on Indian stock market.

A stock simulator lets you, test your strategy about stock market without risking your money in real life. In moneybhai, you get a corpus of ₹ 1 crore to buy shares in delivery as well as for intraday trades.

So, let’s dig deep into India’s biggest investing simulation game!

How to get started with Moneybhai

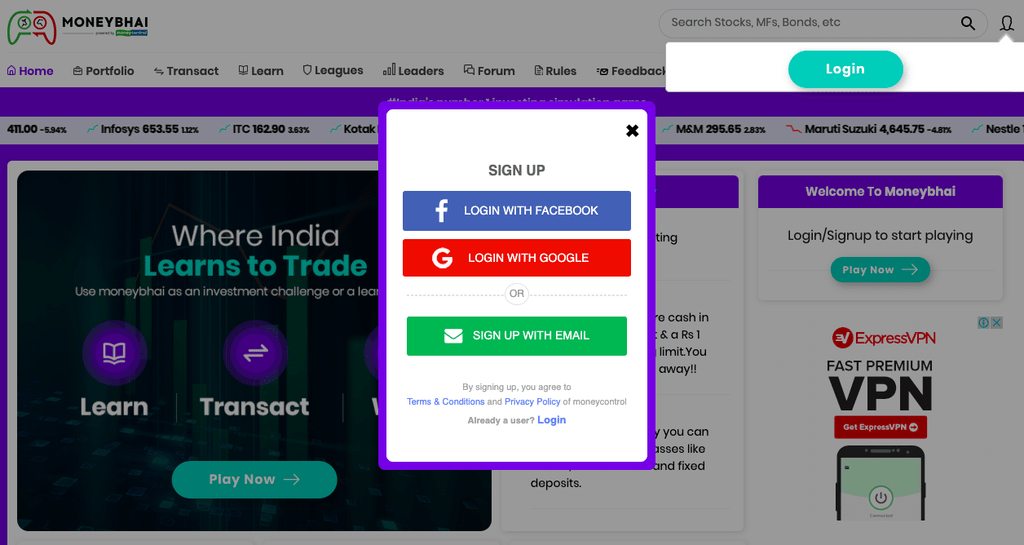

You need to register yourself on the site to be able to use any of the feature.

You can register using facebook, google or your email id.

Once you have registered, then you need to log in at least once in a day to be able to claim investing game prizes.

Once you have created your account, you will have cash in your portfolio account. You will also get an intraday trading limit.

With this virtual money, you can invest in all the allowed asset classes. Asset classes allowed here are stocks, mutual funds, bonds, and fixed deposits.

Important: You can not trade on futures & options on Moneybhai.

Important points:

Types of orders allowed on Moneybhai

- Limit Order

- Market Order

- GTC (These order stay live in the system for either 5 days or till they get executed — a nice feature)

Brokerage and STT charged

To keep things as realistic as possible, moneybhai charges brokerage just like it is their in normal trading accounts.

In Moneybhai we will be charging 0.50% for Stocks, 0.10% for Stocks-Intraday, 0.50% for Mutual Funds when you sell the fund , 0.50% for Bonds

— Rules and FAQ on their site

In my opinion, the brokerage charged in not realistic. Now that many good quality brokerages ( Zerodha, Upstox) are charging ₹ 20/- per order on intraday trades, and ₹ 0 on delivery trades.

STT is also charged at government rate (0.125%) for equities.

Key features

Monebhai does offer good features for those are still learning about swing trading and investing in stock market.

- If you have used up the entire money, you can reset it back to the original portfolio balances/cash. So, you do not lose anything here even if you do not win.

- MoneyBhai uses actual market data from the share market. This offers real-time exposure, similar to using a brokerage account for trading in.

- You have a leaders dashboard which is updated every 20 min. You see people who are performing good and chose to follow them to refine your own strategy.

It helps you understand the nitty-gritty of the share market without using and spending your own money.

And especially if you are training to be a trader, then you can try the high virtual capital to understand leveraged trading. It helps you refine your trading strategy without putting your real money at risk.

Frequently Asked Questions:

Do I need actual money to test my strategy on Moneybhai?

No, you don’t need actual money.

Moneybhai is a virtual stock market simulator that gives you the experience of the stock market and how it behaves.

Once you complete your registration, you get ₹ 1 crore of virtual and intraday money margin to test your strategy. If you have spent all this money, then you reset your margin at any time.

How do I delete a portfolio on MoneyBhai?

– The Delete option allows you to remove Portfolio from your Portfolio Tracker.

– Go to Portfolio Tracker Homepage, select the portfolio from which you want to delete the scheme and click on <Go>

– Select the schemes that you wish to delete from the Portfolio Tracker & click on <Delete>

What are the key features of Moneybhai?

1. You trade with real time data to keep the experience as close to real world as possible.

2. If your strategy testing leads to losses, you can rest your portfolio back anytime.

3. You get a generous amount of ₹ 1 crore as virtual trade money to invest and trade.

4. Leadership board is online competition game on the platform you compare your strategy with other participants.

What is Moneybhai?

Moneybhai is a virtual stock market learning platform by Moneycontrol.com. By using virtual cash you can trade real time in market and improve your skills.

Tags Moneybhai, Moneybhai stock simulator, stock market simulators in India,

is options and futures simulation is available on this platform ?

No, Futures and options simulations are not available on Moneybhai. It’s oriented for cash-based transactions.

I think simulation with options and futures would be good because this is one of the component with which people really needs to understand about gamma , Teeta and delta and all. It would be good if you could come up with the same.

Is fantasy stock gaming app with real money legal in India?

That’s little bit of grey area from legal point of view. We have gaming apps like dream11 working perfectly fine in India, so stock gaming app should work too.

how can i delete my profile from money bhai ?? or can i change my name?? also will my moneycontroll account will be deleted if i delete my moneybhai account