If you are a Share Trading student, you will have heard of the charges that the broker company charges for you to trade. But do you know much about them? This blog will show you the different charges on share trading that are involved and how they are calculated.

Explanation of the different stock trading rates. Brokerage, STT, DP and more (update): Buying and selling shares in India is subject to a number of charges and taxes. Some are fairly well known, such as brokerage fees and GST, but there are many more that traders and investors are not aware of. In this post, I will explain all the different types of costs in stock trading. Some of the most common ones are brokerage fees, Securities Transaction Tax (STT), stamp duty, etc.

Before we get into it, let’s take a few minutes to learn some of the basics you need to know first. So stay with me for the next 10 to 12 minutes to understand the explanation of all the different costs associated with stock trading. Let’s get started.

1. Intraday trading and delivery

Many beginners trade stocks and confuse them with investments or supplies. However, the two are very different from each other:

- Intraday trading: When you buy and sell stocks on the same day, these are called intraday transactions. If you z. B. bought a stock in the morning and sold it before the market closed for the day, this would be considered an intraday transaction.

- Mail order: In contrast to intraday, when you buy a stock and hold it for at least one day, this is called delivery. If you z. B. bought a stock today and sold it three days later (or on a day other than today), this would count as a delivery. Here you can sell the shares tomorrow, the next day, the next week, the next year or in 20 years.

2. Full service and discount brokers:

- Full service broker: These are traditional brokers offering a full range of services for trading stocks, commodities, currencies, mutual funds, etc., as well as research and advisory services, portfolio and wealth management, and individual account management. For example, ICICI Direct, Kotak Securities. HDFC Securities, etc.

- Discounted brokers: These are the cheap brokers that offer high speed and the most advanced execution platform for trading stocks, commodities and currency derivatives. They charge a small commission (fixed price) and do not give negotiation advice. For example, Zerodha, 5Paisa, Angel Broking, Trade Smart Online, etc.

Also read: Best discount brokers in India (Updated 2021)

In general, a full-service broker charges a commission of 0.03% to 0.60% of the trading volume when trading stocks. Discount brokers, on the other hand, charge a flat fee (a fixed amount of Rs 10 or Rs 20 per transaction) for intra-day transactions. Most discount brokers don’t charge commission for delivery transactions either.

It is important to note that brokerage fees are charged on both sides of the transaction, i.e. when buying and selling shares. Let’s take an example to better understand what a brokerage commission is.

Suppose there is a brokerage company with the name – ABC. This broker now charges a brokerage fee of 0.275% for intraday transactions and 0.55% for deliverable transactions. The total cost of the two transactions can be represented as follows: …..

| Intraday trading | Delivery trade | |

|---|---|---|

| Brokerage activity | 0.275% of total sales | 0,55% of total sales |

| Sales | If you buy 100 shares at Rs 120 and sell them at Rs 125, the total turnover is (120*100+125*100=) Rs 24,500. | If you buy 100 shares at Rs 120 and sell them at Rs 125, the total turnover is (120*100+125*100=) Rs 24,500. |

| The total cost of mediation servicesTotal brokerage fee for intraday trading (buying and selling) = Rs. 24,500 * 0.00275 = Rs. 67.38 lakhs | Total brokerage for delivery (buying and selling) = Rs. 24,500 * 0.0055 = Rs. 134.75 lakhs |

As the competition among brokers is constantly increasing, these brokerage commissions offered by different brokers are also decreasing. For example, discount brokers like Zerodha offer a flat commission of Rs 20 or 0.03% for intraday trades (whichever is lower), and investments with delivery are FREE. Here are the brokerage commissions for the different segments offered by Zerodha.

– Mail order: FREE (Rs 0)

– Intraday Trading : Rs 20 per transaction or 0.03% (the minimum is retained)

– Equity Futures : Rs 20 per transaction

– Stock options : Rs 20 per transaction

So, for the above table, assuming the same scenario, a person pays only Rs 7.35 lakhs for intraday trading and zero brokerage on delivery if he chooses Zerodha as his broker. Other discount brokers like 5Paisa, Upstox, Angel Broking, etc. also offer such low brokerage fees.

In addition to brokerage commissions, there are several additional fees and taxes that must be paid when shares are traded. As mentioned earlier, these include securities transaction tax, service tax, stamp duty, transaction fee, SEBI turnover fee, depository participant (DP) fee and capital gains tax (which you have to pay at the end of the financial year but not at the time of transactions).

First, let’s understand these other trade costs and their associated taxes. In addition, at the end of this post, we will also look at an example to better understand what the costs and fees are.

Charges on Share Trading

Securities Transactions Tax(STT)

- After brokerage fees, these are the highest costs charged in stock market transactions.

- In the case of a transaction with delivery, the STT is levied on both sides of the transaction (purchase and sale) and amounts to 0.1% of the total transaction price (on both sides of the transaction).

- In intraday and derivative transactions (futures and options), STT is levied only on the sale of shares. For intraday sales, the TFS fee is 0.025% of the total transaction price.

- For equity futures, the STT is 0.01% on the sell side. In contrast, when trading stock options, the STT is 0.05% on the put side (at a premium).

Stamp duty

Stamp duty will be payable uniformly and independently of the country of residence from 1 July 2020. These new rates only apply to the buy-side (not the sell-side and buy-side). Below are the new stamp duty rates for different types of transactions:

| Commercial type | New stamp duty rate |

|---|---|

| Transactions in shares with delivery | 0.015% or Rs. 1500 per crore on the buy-side |

| Intraday share trading | 0.003% or Rs. 300 per crore on purchase |

| Futures (stocks and commodities) | 0.002% or Rs. 200 per crore on the buy-side |

| Options (stock and commodity options) | 0.003% or Rs. 300 per crore on purchase |

| Currency | 0.0001% or Rs. 10 per square inch of the side of the purchase. |

| Investment funds | 0.005% or Rs. 500 per crore on the buy-side |

| Bonds | 0.0001% or Rs. 10 per square inch of the side of the purchase. |

A quick tip: Earlier, stamp duty was levied by the state government and hence it was not equal in all states of India. Some states have higher stamp duty, while others have lower stamp duty. Stamp duty varies from state to state. Moreover, the stamp duty used to be levied by both parties to the transaction at the time of the exchange (i.e. purchase and sale) and is thus levied on the total turnover. **This rule was adopted after 1. July 2020 amended.

Transaction costs

- Transaction fees are charged by the exchanges on both sides of the transaction. These costs are the same for intraday transactions and delivery transactions.

- The National Stock Exchange (NSE) charges a commission of 0.00325% of the total turnover as a transaction fee for trading in stocks and supplies. On the other hand, the Bombay Stock Exchange (BSE) charges a commission of 0.003% of the total turnover as transaction costs for trading in shares and stocks.

- The BSE does not charge transaction costs for transactions in derivatives. In contrast, the NSE’s transaction costs are 0.0019% for futures and 0.05% of total revenue for options trading.

SEBI turnover commision

- SEBI stands for Securities and Exchange Board of India and is the regulatory authority for the securities market. SEBI issues rules and regulations for the proper functioning of stock exchanges.

- SEBI turnover commission is levied on both sides of the transaction i.e. buy and sell side and is same for all intraday transactions in shares, deliveries, futures and options.

- SEBI’s turnover commission is Rs 10 crore per crore of total turnover.

Fees for Depository Participants (DP)

- There are two securities depositories in India – NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited). When you buy a stock, it is stored electronically in a brokerage account. Dealers charge a certain flat fee for this service.

- Depositaries do not charge fees to traders or investors, but they do charge fees to the depositary. Here, the brokerage firm or company that manages your dematerialized account is the custodian (DP).

- A PD acts as a link between the custodian and the investor, since investors cannot contact the custodian directly. In short, the depositary invoices the DP and then the depository participant (DP) invoices the investors.

- For example, in case of trading on Zerodha, the DP fee is ₹13.5 + GST per share (irrespective of quantity) on the day it is debited from the trading account i.e. when the shares are sold. This commission is collected by the depository and the participant in the depository.

Goods and services tax (GST)

The GST is a mandatory tax levied by the government on services provided and represents 18% of total brokerage and transaction fees.

Capital gains tax

Finally, capital gains tax is the most important tax for traders and investors to understand in this article. In this article, we will not go into all the details of capital gains tax, but only give a brief summary of it. If you want to read all the details, you can read this article.

- There are two types of capital gains tax in India: short-term capital gains tax and long-term capital gains tax.

- If you sell the stock before one year from the purchase date, it is considered a short-term stock. In this case, a flat tax of 15% of the profit is levied as a short-term tax on capital gains.

- If you sell a stock after owning it for a year, it is a long-term stock. For long-term capital gains, you have to pay 10% tax on the amount of capital gain if it exceeds 1 million rupees.

- Intraday traders must pay capital gains tax based on their tax bracket. For example, if you are in the highest tax bracket and you have made a profit from intraday trading, you will have to pay 30% tax on that profit.

A quick tip: You can also download our FREE Android Broker Calculator app to get the total brokerage fees and actual profits/losses of stock transactions on your phone. Here’s a quick link!

Example of different share trading fees

Now let’s take an example to better understand these different stock market transaction costs and the taxes associated with them. Suppose there are two traders, Rajat and Prasad. Here, Rajat is a purchasing merchant who invests for the long term i.e. 2-3 years. Prasad, on the other hand, is an intraday trader.

Both have their accounts in the same discount brokerage called ABC. The brokerage fee for ABC is Rs 20 per transaction for intraday transactions and is FREE for delivery transactions.

Let us also assume that Rajat and Prasad realized a total share turnover of Rs 98,000 (i.e., the total value associated with the purchase and sale). Besides, they both live in Maharashtra.

The various costs and taxes they pay for the entire transaction, i.e. from the purchase to the sale of the shares, can be represented as follows.

| Prasad (intraday trader) | Rajat (delivery boy) | |

|---|---|---|

| Purchase price | 120 | 120 |

| Sales price | 125 | 125 |

| Quantity | 400 | 400 |

| Total turnover | 98000 rupees | 98000 rupees |

| Exchange | NFB | NFB |

| Status | Maharashtra | Maharashtra |

| Commission | Rs. 40 (salary of Rs. 20 per transaction i.e. buying and selling) | 0 Rupees (free shipping) |

| TFS | 0.025% of the sale amount = 0.025% of Rs. 50,000 = Rs. 12,5 | 0.1% to buy and sell = 0.1% of 98000 = Rs. 98 |

| Stamp duty | 0.003% of the purchase amount = 0.003% of 48,000 = Rs. 1,44 | 0.015% on the purchase side = 0.015% of 48,000 = Rs. 7.2 lakhs |

| Transaction costs | 0.00325% of total sales = 0.00325% of Rs. 10,000 = Rs. 3,18 | 0.00325% of total sales = 0.00325% of Rs. 10,000 = Rs. 3,18 |

| SEBI Rotation Committee | Rs. 10 / Total turnover = Rs. 0.10 | Rs. 10 / Total turnover = Rs. 0.10 |

| GST | 18% on (brokerage + transaction fees) = 0.18 * (40+ 3.18)= Rs. 7,77 | 18% on (brokerage + transaction costs) = 0.18 * (0 + 3.18) = 0.57 |

| Total brokerage and taxes | 64.99 | 109.05 |

| Total profit or loss | 1935.01 | 1890.95 |

| Capital gains tax | According to the control bar | Depending on the short/long storage period |

At first, glance, investing in intraday assets is cheap because the total cost is relatively lower. However, you should keep in mind that the trading frequency for intraday traders is quite high. Many intraday traders easily make 2-3 high volume trades per day. They still have to pay brokerage fees and taxes. On the other hand, delivery traders or long-term investors don’t trade that often.

In general, fees and taxes are a very important part of business and should not be ignored. You may think you are making a profit, but the real profit is what is left after deducting expenses and profit. I hope the merchants keep that in mind before they act next time.

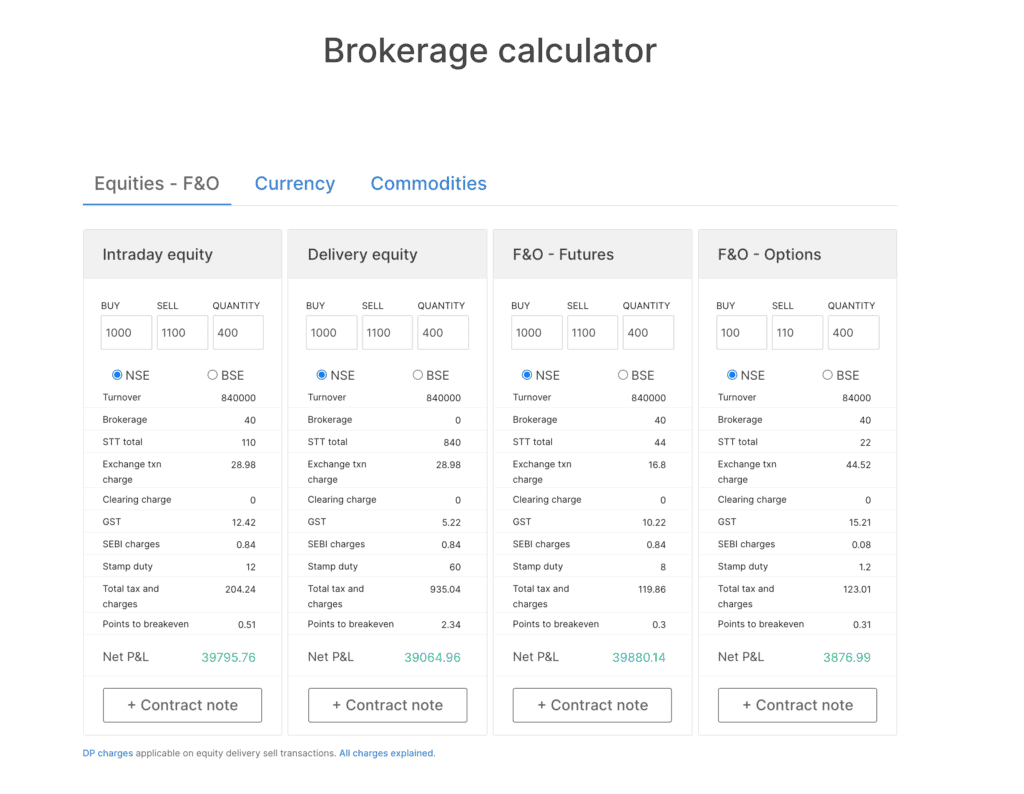

Zerodha brokerage calculator

Before we end this article, here is a brokerage calculator for trading stocks with Zerodha, a discount broker.

So much for this post. If you have any doubts about the different stock prices in India, feel free to leave your comments below. I’d like to help you. Good health and good business!

Frequently Asked Questions

What is STT?

STT trading fee is the fee charged by the platform for the transaction. This tax is by the government when transacting on the exchanges. Charged as above on both buy and sell sides when trading equity delivery. Charged only on the selling side when trading intraday or on F&O.

What are DP charges?

DP charges are debited from the trading account when stocks are sold. It is irrespective of the quantity sold.

How is brokerage charged on share trading?

Brokerage charges are in this sequence:

– Brokerage

– STT/CTT

– Transaction charges

– GST

– SEBI charges

– Stamp charges