Do you know the most common response to tell anyone that you trade in the stock market?

It is very risky, stay away from it. Or Stock trading is gambling. Isn’t it?

And let me tell you – Trading is risky. Be it is stocks, futures, commodities, or any other instrument.

But, it is risky not because of the market. It is because of the trader.

Let’s get more into detail about it and also learn how we can make it less risky by understanding risk management.

What is the risk in stock trading?

The main risk in the stock market is unpredictability. At least that is the main perception.

Any news or event leads to a crash or sudden rally in the stock market. And most of the time, the movement in the stock market is the opposite of what is being reported in the news.

And if you are a technical analyst, you face more problems. You realize the market is not functioning as you learned from trading methods.

How many times it has happened that you saw a perfect trade set-up and took a trade. For some time trade went in your favor and then boom – it reversed the whole moves?

Even statistics show, how risky is trading – Only 4-5% of traders succeed in the market.

This was true when there were no computers, and this is true today when you have algorithm & coded trading systems to help you.

This is the risk in the market

Does that mean you can’t do anything about it?

Actually, you can. If you want to success in stock market trading, you need to learn the most important skill for that – risk management.

What is risk management in trading?

Trading, is quite like driving a car. Especially the one where the windshield is not clear and it’s foggy outside.

And here are the things you can improve in such a situation:

- Making the windshield clear (trading plan)

- A well serviced car (robust trading platform)

- Wearing seat belt and driving with awareness (risk management).

In the case of trading, risk management is protecting your trading capital. Like you wear a seat belt to protect yourself. Even if you are driving for many years.

In the market, there are many factors that can go against you. Here is a quick list of risk factors in the stock market:

- News & announcements

- Your trading platform

- Market moves

- Wrong trades

- Wrong information

Does this makes stock market more risky than crossing a busy road? No, it means like there are steps you take while crossing the road, there are steps you take to trade in stock market.

These steps are part of risk management. And stop loss is not that.

Stop loss is not risk management

Most of the time, beginner traders assume that keeping a stop loss is risk management. Which is not right.

Stop loss is just one of many ways to manage risk. Whereas risk management is a concept in itself.

Taking our example from driving a car – for your safety while driving, seat belt alone is not enough. You need good tires, working brakes and lights to keep you safe on the road.

Similarly, risk management involves:

- Position Sizing

- Monitoring the trade

- Avoiding unclear trade set ups

- Booking regular profits

- Hedging carried positions and

- Stop loss and trailing stop losses.

What is position sizing & how to calculate it per trade?

First let us understand what is position sizing?

Position Sizing:

Position sizing means to adjust your positions according to your trading capital.

When you have low capital your small positions when you have more capital you have bigger positions.

Adjustment according to stop loss and trading capital is called position sizing.

When you stop loss is for you to have a small position when you stop loss is close you take more risk.

When you are adding in the profitable trade you had according to the trailing stop loss. You don’t add in loss-making trade.

How to calculate position size per trade?

Let’s say you are reading in Banknifty, where lot size is 20. That means you gain or lose ₹ 20 with each ₹ 1 move in prices in Banknifty.

Let’s say according to your trading capital I want to risk only Rs.2000 for the trade. And your stop loss is 100 points away.

This will mean that you can only take 2000/ (100*20) = 1 lot in this trade.

If risk is of 4000, then 2 lots and so on.

Even if you keep the risk to ₹ 2,000, but stop loss is 50 points away, you can take 2 lots in same trade.

All it takes is few minutes on you calculator to decide your positions size.

Monitoring the trade

If you are day trading, this is not that important because any way you are monitoring your trades.

But in case of swing trading, it is very important to monitor your trades.

There are two part of monitoring –

- Updating Stop loss as per trade movement.

- Checking the trade set up itself.

The first part of updating the stop loss as per the movement of the trade is easy to understand.

It is the second which is often overlooked. Checking your trade set up or charts.

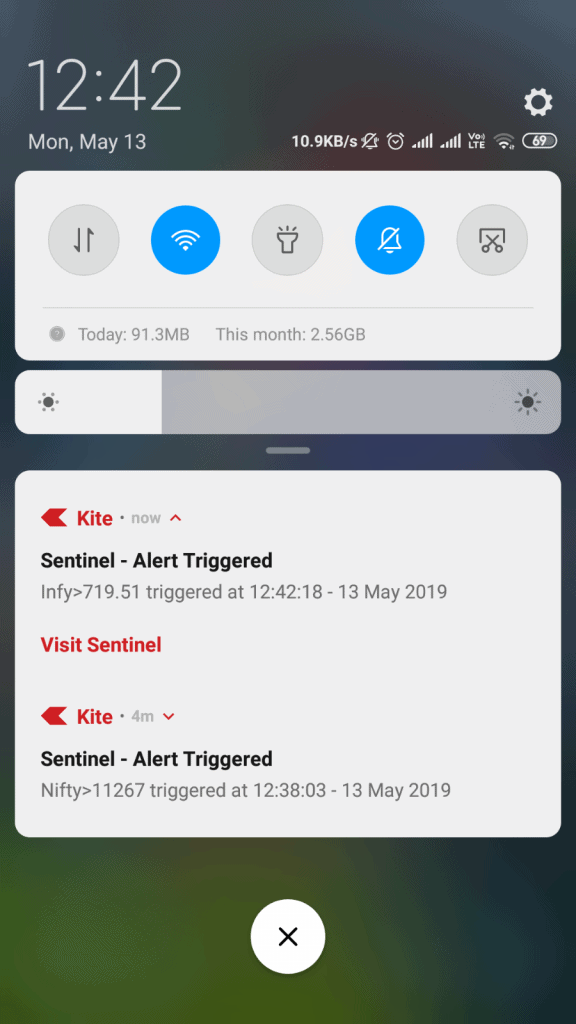

You can monitor your trade by setting alerts. If you are trading in cash – then investing.com allows you to set alerts, for which you get notifications:

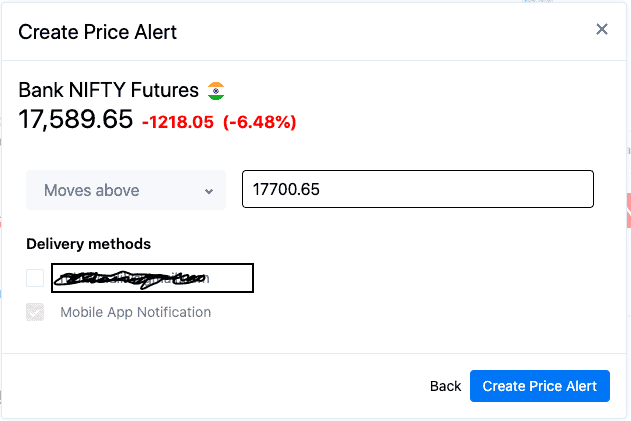

Or you can set alerts on your trading terminal too:

Avoid unnecessary trades

Money saved is money earned.

When you avoid a trade that is not a clear setup, you also protect your trading capital from losses.

What is a unclear trade set up?

Let’s say you trade based on the certain chart set up like trend lines or support and resistance. And along with these numbers you also use moving indicators like EMA, MA, etc.

In this case, an unclear trade set-up is when one of your indicator is clear but others are not yet clear.

This means, you trade only when all the factors of your system are agreeing to each other.

For a trader to make money from the stock market, regularly, one of the most important factors is patience to wait for the right trade.

If you are not sure about a trade, don’t trade. Don’t second guess yourself.

Booking profits regularly

A trend can change anytime and one of the best defenses against that is booking your profits regularly. At least partially.

You should always book a part of the trade after you have gained a certain profit in your trade.

This regular booking of profit helps you in two particular ways:

- As your profit increases, a reduction in trade size keeps the profit at a manageable level. Then, it is easy to carry the position to the very end.

- Most of the time market turn midway, but if you have booked partial profit at a higher level, you are still in profit. This is good for the overall performance of the trading system. And your trading capital 🙂

Consistently earning profits, big or small, is very good for overall risk management strategy.

Hedging your positions

This part is not applicable if you are trading in 1or 2 lot. In such cases, you should focus on improving your trading system and other strategies of risk management.

When you are swing trading, you carry your positions for a few days. To protect yourself against unexpected surprises, you should hedge your positions.

One of the simplest ways to hedge your positions is to buy options. So, if you are long in Nifty futures, you can buy near strike options to hedge your position. Though a better choice will be to write options.

There are multiple ways to hedge your positions. This is especially true if you are trading with good trading capital. Then you can use various options trading strategies to create low risk – high-profit setups.

Stop loss & trailing stop loss

Stop loss is your most important tool from the risk management perspective. It is the one that protects you from wiping out your trading account.

I will repeat again – No trade is 100% sure.

You may be right, even 90% of times (unlikely), but it is about protecting your capital in that 10 %.

I have many accounts (mine included) suffer heavy losses, in 1 trade that went wrong.

Never miss the stop loss. To learn about using stop losses effectively, I have published a complete post about it. Learn how to put stop loss correctly.

How to develop your own risk management strategy – even if you follow tips.

The above-mentioned steps are all part of the risk management strategy for retail traders.

Proprietary trading firms, algo trading firms, and similar professional firms use multiple complex methods to manage their risks. These advanced methods are of no use to a retail trader, hence learning about them will only make it complicated.

The best way to develop your own risk management system is to study your trades, most preferably from your trading journal, and start testing.

Let’s take a very simple example, let’s say you trade based on recommendations broadcasted on TV channels like CNBC. Now, after studying your trading journal you realize that most of the calls move at least 2-3 points in your favor, before either hitting the target or stop loss.

This means you can book partial profit at the initial move of 2-3 points in your favor and hold the remaining part of trading.

Or, you avoid trades in which you have conflicting views from channels you follow.

Similarly, if you follow charts, spend time on your previous trades and chart setups you used. You will definitely find a point on how you can manage your risk of trading in a better way.

You can test these strategies without risking your real money by trading on virtual trading platforms.

Final thoughts on Risk Management

If you don’t have a proper risk management system in place, then you are gambling with your trading capital.

The reason that most of the beginner traders fail is that they focus too much on finding the best performing trading method.

The truth is that there are many trading methods that earn money. None of the trading methods work in all the market conditions. And market conditions keep on changing.

The only thing to ensure that you protect your trading capital and you earn money from the stock market is your risk management system.

If you have any queries about risk management for your trading system – do visit our forum and post your query.