Have you faced a situation where you set an alert for a certain price of a stock? You get the alert, but by the time you are active in front of your trading terminal, the price is missed?

One of the best ways to maintain this was having the service of a full-service broker, where you ask your dealer to take certain action when your desired price is there. But this is not possible when you are trading on our own, or trading with discount brokers.

Zerodha GTT is a solution to such scenarios. GTT here means Good Till Traded. It means this type of order will stay in Zerodha system, till the conditions are met. As soon as the trigger is there, the order will be placed in the system. Automatically. No more updating the order on a daily basis.

Let’ have a deeper look into this facility as well as find out how to use it properly.

What is Zerodha GTT

Zerodha introduced GTT in July 2019. Unlike developed markets, stock exchanges in India don’t allow such features on their system. Thus, at the end of each trading day, all the pending orders are canceled by the exchange.

This means, if you placed a stop loss in your position today, it needs to be placed again every day when the market opens.

To solve this issue Zerodha came up with the GTT order concept. Being a text first broker company Zerodha has set the standards with this concept.

So what Zerodha has done is that you can place your order as GTT. But it stays in the Zerodha system until your trigger price is reached. As soon as your trigger price is reached the order is placed into the exchange.

Every such order is either valid till it is executed or for a period of one year and that is a long duration for most of the orders.

How to place GTT orders

In the kite apps of Zerodha GTT orders can be placed in two ways:

- The order tab on Kite web

- Market watch list.

The function is a little different in both the ways I will explain it to you separately.

Placing GTT order from Order tab on Kite

On kite web, when you click the order tab – you reach this screen:

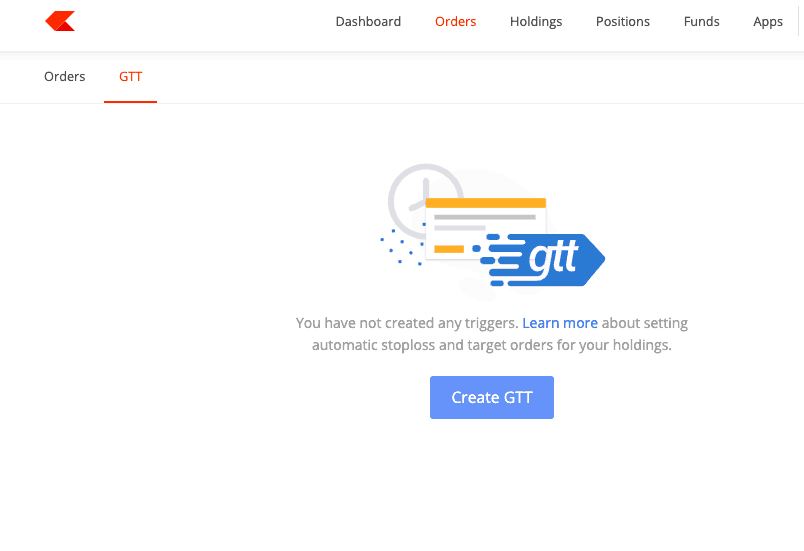

Here you click on GTT tab and click create GTT:

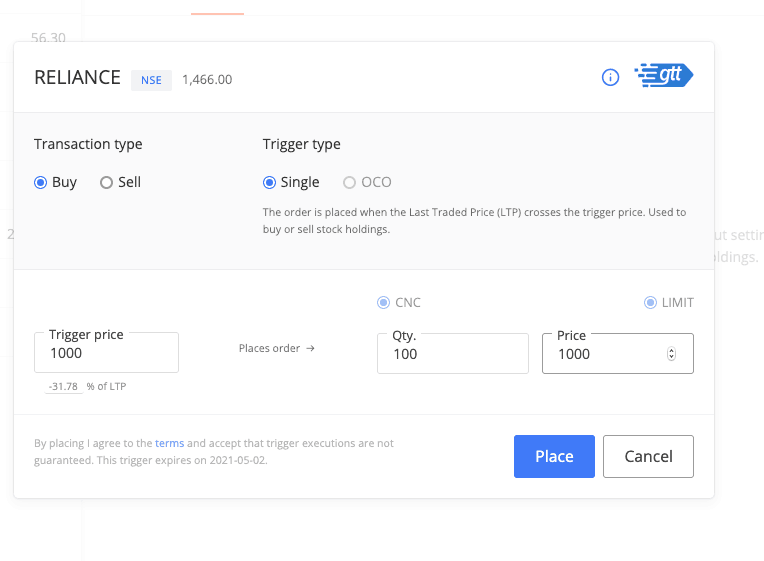

Now in these options, if you haven’t bought the stock yet, you click on the buy tab and place your order as limit or as stop-limit order. You can even split your order into multiple parts by placing separate order at each limit price.

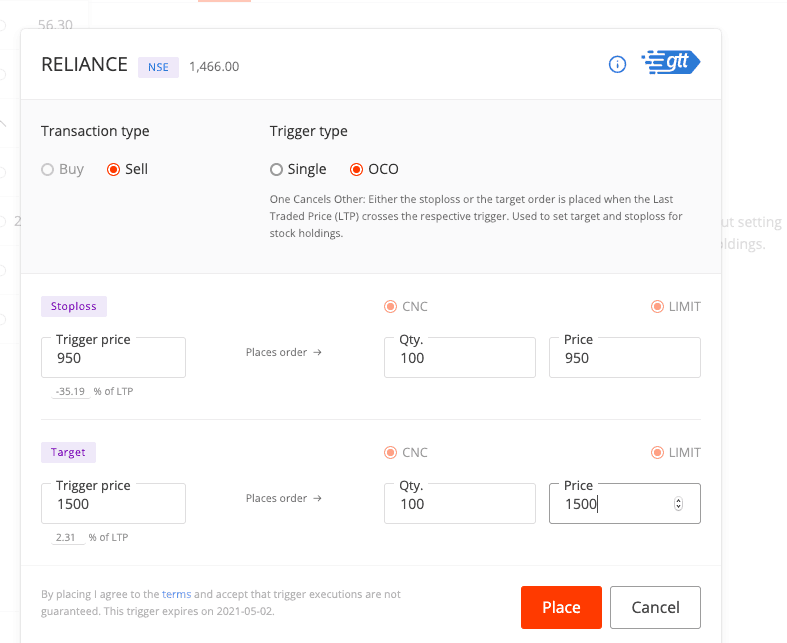

Now, once your buy order is placed or if you already have to stock in your Demat account, then you click the sell order type. Here you get the choice of placing the limit order or OCO order (one cancels the other).

{Read here about all the order types and what they mean}

If you have a target price to exit the stock, then you should use the OCO order so that your stop-loss is also placed at the same time.

Where if you only want to place the stop loss then you place it just like the buy order above.

When you place orders through the order tab, you have to place the buy and sale order as two different orders. If you want to place all these orders in one go, then you can do that by using the market watch.

Placing GTT order from Marketwatch

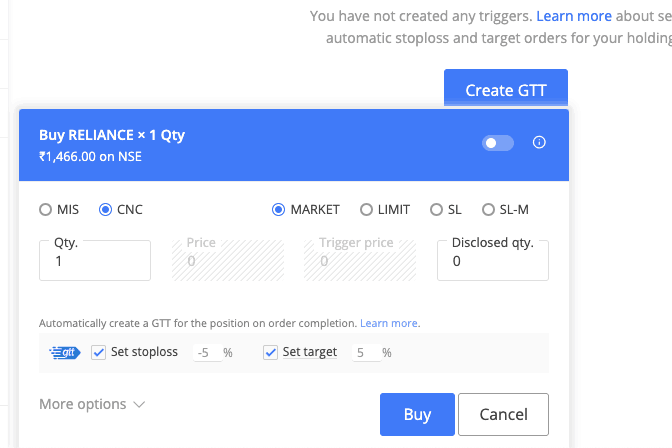

If you are comfortable with calculating the prices in percentages, then you can actually place the whole order from one window only.

One more issue in this order is that one part of this order will be a limit order for the day. Only the exit options can be set in the GTT type.

Just click on the stock in the MarketWatch and you will see this order window:

As you can see, just below the boxes where you put your order, you can see the GTT order options.

Here you will see the difficult part – you need to put the percentages. So, you need to calculate how far is your target price and stop-loss price from the current market price and then put in those percentages.

This is useful for traders, who have a trading system that follows a 2% stop loss and 2.5-5% (or more) of target price for trading.

Important details about Zerodha GTT orders

What are the charges for using Zerodha GTT?

GTT order facility by Zerodha is completely free to use (as of May 2020). If there are any changes in their pricing, I will update it here.

Will GTT order stay in the system forever?

No, the base validity of the Zerdha GTT order is 1 year. Or till the time it is traded. One important thing: As you can see that Zerodha will forward your GTT orders as a limit order in the exchange, which means if it is not traded on that day due to any reason, it is just another order for the day and will be canceled at the end of the day. So you need to check your app for order execution when the trigger price is reached.

How to put the GTT order in Upstox/Angel Broking?

For now (May 2020), Upstox and Angel broking don’t offer a GTT order facility similar to Zerodha GTT orders.

Can I place GTT orders after market hours?

Yes, you can. In the video in this post, I have placed both the orders after market hours. Orders were placed without any error.

Can you create GTT orders for futures and options?

No, you can not use the GTT order facility for futures and options. The reason might be that the order validity in 1 year whereas futures and options expire on a monthly basis (& weekly basis for index options).

Do you need to have the required margin in your trading account for the whole duration?

No, the GTT order in GTT stays in the system without testing the margin amount required for fulfilling the order. Only when the order is triggered, it will check the margin and then place the order. Which also if you have placed the sell order of a stock, and it is triggered before the buy order (which is separately placed), then you can have a short position. You need to be careful about placing a sell order before you have the required shares in your Demat account.