There are many ways for a listed company to raise money and among the different ways is rights issue. Right issues are the issues that are making money for the company, for the management, and for the investors. On the other hand, wrong issues are the ones that aren’t making any money, but still are being paid every year by the investors.

Today we try to understand the term rights issue as a share of a company, as this will help us make a more accurate decision when a company whose share is in our portfolio offers a rights issue.

What are the rights issue?

A rights issue is a way for a company to raise capital. In a rights issue, the company only offers existing shareholders the opportunity to acquire additional shares in the company.

The price the company offers to existing shareholders is a discount to the market price. This is intended to make the offer attractive to shareholders while compensating for possible capital dilution. A rights issue also gives shareholders the opportunity to increase their stake in the company. Shareholders have the right, but not the obligation, to acquire shares.

Why do companies choose to issue rights?

The nature of the right of issuance also makes the equity share an asset, as it allows companies to raise capital regardless of the environment in which they find themselves. Distressed companies may choose to issue rights to pay off their debts or use them as a way to raise funds for their operations when they cannot borrow money.

Is the right problem a red flag for the company?

The good proposal is certainly not a red flag. In fact, the right offer is also seen as a way to attract additional capital for the expansion and growth of the business.

Sometimes the gestation period of a project that a company undertakes can be too long before it becomes profitable. In such cases, it is not wise to opt for a loan, because interest has to be paid regularly even before the project is operational, let alone profitable, making the loan too expensive. A rights issue, therefore, appears to be a win-win situation for the company and the shareholders. The reason is that good results do not require regular maintenance as long as the project remains on track for success and the future.

In a recent scenario, Reliance Industries also decided on a rights issue but to clear the balance sheet of all debts while rewarding the shareholders.

Can an unlimited number of shares be repurchased in a rights issue?

Rights issues operate differently than an initial public offering (IPO) or a subsequent public offering (FPO). When rights are issued, the shareholder has the opportunity to acquire rights, but only in proportion to the shares already held. In RIL’s recent issue, shareholders were offered shares at a ratio of 1:15. This means that for every 15 shares held, one share can be acquired through a rights issue.

The extent to which shareholders can acquire shares is therefore limited to the shares they already own. However, investors have the option to sell their right to buy shares. However, shareholders are free to buy the right that another investor wants to sell on the market.

Different types of correct questions

There are two main types of rights issues, namely

– Waiver of rights issue: If a shareholder is offered redeemable rights, the shareholder has the option to acquire shares by exercising the right, disregarding the right, or selling the right at the price at which the rights are traded on the stock exchange.

– Rights issue without right of refusal: If a shareholder is offered irrevocable rights, his or her only options are to acquire shares by exercising the right or ignoring it. If these rights are offered, a shareholder cannot sell his or her right to another investor.

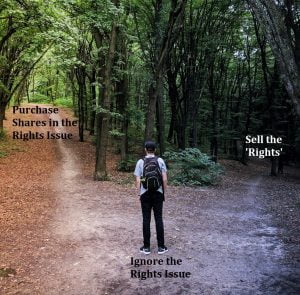

Are you making the right decision?

Although the rights issue is not an obligation, it gives investors the choice of buying shares in the company, ignoring the issue or selling the right themselves. We will now look at the various options from a purely financial point of view.

Example: Suppose you own 1,000 shares of Pineapple Ltd, whose shares are currently trading at Rs 21. Pineapple Ltd is proposing a rights issue where the shares will be offered at a discount of Rs 15 per share. The correct bid was made in the ratio 2:10. The company has already issued 100,000 shares as part of the IPO and plans to raise Rs 300,000 million under the rights issue, taking the total number of shares to 120,000.

1. Acquisition of shares through the issue of warrants

Here we will look at the subject of buying stocks. One of the key elements of the rights issue is the strike price. The ex-rights price is the theoretical price after the rights issue. The calculation of this price helps the investor to decide on a financial basis whether to buy the share through the right or not. Let’s get started.

- Shares held by Pineapple Ltd – 1,000 shares (a)

- The current stock is valued at Rs 21,000 crore in the market.

- The number of shares granted by the claim offer is = (1000 x 2/10) i.e. (existing shares x proposed ratio) = 200 shares. (b)

- Cost of participating in the free issue = Rs. 200 x Rs. 15 = Rs. 3000.

- Total number of shares held after the issue (if successful) = 1000 + 200 = 1200 shares.

- Value of the portfolio including the investment from the dues = 21000+3000 = Rs. 24000.

- Price of right (value per share after issue) = Rs. 24000/1200 = Rs. 20 per share

The above investment will prove profitable because even if you paid Rs 15 per share, you can theoretically expect it to be worth Rs 20 after the issue.

2. Selling the right yourself

The rights you have as a shareholder to buy Prava shares have an intrinsic value and can be traded on the stock exchange. These are the so-called zero-duty rates.

We have already calculated the correct price above. In some cases, it is advantageous for the rights to trade at a price equal to or greater than the difference between the bid price and the offer price of the rights.

i.e. (20-15) = Rs 5 lakh.

What happens if a shareholder simply waives his right?

Sometimes a shareholder may decide to do nothing about a right and just ignore it. It is important for a shareholder to be aware that the subscription rights granted here carry a risk of dilution if not exercised. Indeed, as mentioned above, the shares issued receive the value of the existing portfolio and of the investments made through the rights. This amount is spread over the entire portfolio at the time of issue.

And if we go back to the previous example, the shareholder would only have 1,000 shares after the issue. Assume the prices on the right are the same. This means that the ex-shares, which were earlier valued at Rs 21,000 crore, will be valued at Rs 20,000 crore after the issue. This is only the beginning of the consequences, as the shares will also be affected in the future, e.g. the company’s profits paid out as dividends will now be distributed among 120,000 shares instead of the previous 100,000.

Correcting questions in a Covid 19 environment

In the COVID 19 environment, several companies have used capital raising through rights issues. These include well-performing companies like Mahindra Finance, Tata Power and Shriram Transport Finance. These companies were able to raise a total of 10,000 million rupees during the pandemic. RIL’s subscription rights were oversubscribed by 1.59 times. The company has received bids worth over Rs 84 trillion and has raised Rs 53.124 billion.

Companies have opted for a rights issue because it enables them to raise capital easily. After all, a proper issue can only be made with the approval of the Board of Directors. This is in contrast to other methods which also require shareholder approval at a general meeting, which is an additional risk in the current climate. In addition, the SEBI has taken a number of steps to facilitate the rights issue process, including. B. the reduction in market capital and minimum subscription requirements.

Final thoughts

Although legal issues were particularly popular at COVID-19, the response was not always equal. Shareholders have always recognized that the actions of a company, however democratic they may seem, are to some extent coercive. The risk of portfolio dilution is always present.

Nevertheless, it is always better not to rely solely on the financial aspect when deciding to participate in a rights issue. It is also very important to know what the purpose of the rights issue is. Moreover, it is a positive sign that the promoters are involved in the rights issue. It shows that they themselves believe in their cause. A rights issue is a type of equity financing in which a company issues new shares to existing shareholders in order to raise capital. A rights issue is an offering of new shares to existing shareholders. In a rights issue, the company sells new shares to existing shareholders at a discount to the current market price. The company then uses the funds to finance the company’s growth, such as through acquisitions, new product development, or investments in new facilities. A rights issue of shares is a process in which a company sells new shares to existing shareholders in order to raise capital.

Frequently Asked Questions

What is meant by rights issue?

A rights issue is a type of equity financing in which a company issues new shares to existing shareholders in order to raise capital.

How does a rights issue affect share price?

A rights issue is an offering of new shares to existing shareholders. In a rights issue, the company sells new shares to existing shareholders at a discount to the current market price. The company then uses the funds to finance the company’s growth, such as through acquisitions, new product development, or investments in new facilities.

What is a rights issue of shares?

A rights issue of shares is a process in which a company sells new shares to existing shareholders in order to raise capital.

Related Tags:

Feedback,rights issue examplehow to sell rights issuestock rights offering good or bad rights issue calculation examplehow to buy rights issue sharesupcoming rights issue,People also search for,Privacy settings,How Search works,Rights issue,Rights issue example,rights issue advantages and disadvantages,how to sell rights issue,stock rights offering good or bad,rights issue calculation example,how to buy rights issue shares,upcoming rights issue,rights issue accounting