Zerodha Kite is the trading platform powered by Zerodha Brokers ltd., the Country’s leading discount broker.

In this blog post, I will provide brief descriptions of the Zerodha Order Types, and explain the various ways these codes can be used by traders on the Zerodha platform. I will also give a brief explanation of Zerodha’s tiered pricing structure, and how it differs from similar products on the market.

Understanding of Zerodha product codes – CNC, MIS, SL, etc: Zerodha is one of the largest stockbrokers in India with over 30 lakh clients. And with such a large customer base, Zerodha’s products and trading platforms are naturally widely used. One of these popular products from Zerodha is the Kite trading platform.

In any case, some acronyms used on this platform may be difficult to understand if a client is not familiar with trading or investing. For example, terms like CNC, MIS, SL, etc. may not make much sense to you if you don’t know what they mean and what they are used for. Nevertheless, once you understand the different Zerodha product codes, it will be easy to use.

In this post, we will discuss the different Zerodha product codes and try to simplify them. Let’s get started.

What are Zerodha order types?

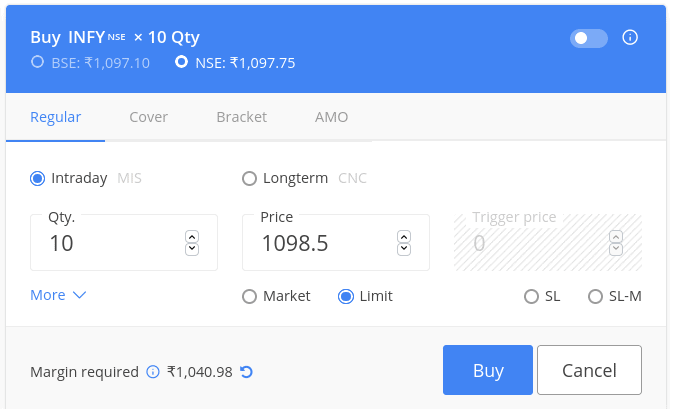

The Zerodha product codes are essentially shortened forms of different codes for performing different actions. For example, CNC, MIS, QTY, PRICE, SL, etc. Here is a screenshot of the KITE application when placing a purchase order, with different codes.

You can highlight different Zerodha product codes in the figure above. It is very important to understand the meaning of these quotes if you want to place your buy or sell order correctly. Let’s start with two easy-to-understand codes: QTY and PRICE.

Here QTY means the number(quantity) of shares you want to buy. PRICE is the price at which you want to buy the stock.

Below are the abbreviations for the other codes we will discuss in this article:

- CNC: Cash N Carry

- MIS: Margin-Intraday-Squaring

- MKT: Market order

- BTL: Limit order

- SL: Stop Loss

- SL-M: Stop Loss at market price

- Trigger Price: Price at which stop loss order will trigger

- Displayed quantity

Before we get into the other Zerodha product codes, here are some common terms you should know first.

- Market order (Market): If you want to buy/sell a stock at the current market price, you must place a market order. For example, if the market price (current trading price) of a stock is Rs 100 and you want to buy the stock at the same or the market price, you can place a market order. Here the order is executed immediately at the market price. However, keep in mind that the market price fluctuates every second. Therefore, the price of your purchase may be slightly different from the price you found before placing your order.

- Limit order (limit): A limit order is the purchase/sale of a stock at a limit price. If you want to buy/sell a stock at a certain price, you place a limit order. For example, if the current market price of the company is Rs 200, but you want to buy it at Rs 195. Next, you must place a limit order. When the market price of ABC falls to Rs 195, the order is executed.

- Stop-Loss (SL): STOP LOSS is used to limit losses when the share price starts to fall. For example, let’s say you are stepping into a stock at a price of Rs 300. However, the price of this stock is starting to fall and you don’t want to take a loss. In such a scenario, you can place an order to limit your losses to Rs 295 lakhs. It indicates that you want to make a transaction, but only if the specified price is reached. A stop loss is a very good tool to limit your risk.

Zerodha common product codes (SL, MIS, CNC, etc.)

- LMT: Used to place a limit order.

- MKT: Used to place a market order.

- Trigger Price: It is used for stop-loss orders. This is the price at which the stop loss must be triggered.

- Stop Loss (SL): This is used to place a stop loss on the limit price. The limit price and the reaction price must be specified here. When the trigger price is reached, a stop-loss order is sent to the exchange at the limit order you specified.

- Stop Loss Market (SL-M): This is used to place a stop loss against the market price. Here you only have to enter the trigger price. When the threshold price is reached, the stop-loss order is sent to the exchange at the market price.

- MIS: MIS stands for Margin Intraday square offWhat is the meaning of Square Off in trading? In trading ter... More. Used for intraday trading with leverage. All MIS items are automatically reconciled at the end of the day.

- CNC: It means cash n carry. CNC is used in the supply industry. No levers are provided in the CNC system. But there is also no automatic squaring at the end of the session.

- Quantity indicated: This allows traders to disclose only a portion of the actual number of shares they are buying or selling. This specified quantity must be greater than 10% of the quantity ordered. For example, let’s say you bought 1,000 shares. However, you can only disclose information about 400 shares (if you wish). Only the specified quantity is displayed on the market screen.

What is the purpose of the quantity declared? The order book is open to all persons active on the exchanges. That way they can all see how much stock you have ordered. However, the problem is that once they know your quantity and price, they can change their own order (increase/ decrease the order amount/ quantity). This can have a negative impact on your orders. The quantity indicated is advantageous for those who process large quantities.

So these were the usual conditions displayed in the market area when you place a buy or sell order with Zerodha.

However, there are other advanced product codes of Zerodha. Although you can execute all your buy/sell orders without changing the extended order, it is best to be familiar with these commodity numbers.

Zerodha Extended product codes (BO, CO, IOC, etc.)

Here are Zerodha’s extended product codes:

- NORMAL : Common commands

- BO: Order of support

- CO: Order the cover

- AMO: Order for the secondary market

- TAG : day length

- IOC: Immediate or abort

AMO: It is short for After Market Order. You can use this tool to place an order if you are unable to buy/sell during trading hours. You can place your order from 4:00 p.m. to 8:59 a.m., i.e., after the close of the session and before the start of the session.

Bracket Order (BO): The clamp control is used for higher levers (than the MIS). Here you place an intraday buy or sell order at the limit with a target and a mandatory stop loss. All orders will be fulfilled by the end of the day.

Covering Order (CO): A cover orderWhat is a Cover Order? A Cover Order is a two-legged order w... More is used to place an intraday buy or sell order on a highly leveraged market order (i.e. when trading with MIS). Here you only have to specify a stop loss. All orders will be fulfilled by the end of the day.

IOC: This means Immediate or Cancel. Here the order is executed as soon as it is placed. If the order is not executed, it is immediately canceled. In the case of a partial run, the remaining quantity (not executed) is canceled.

Summary: Zerodha product codes

Let’s quickly summarize some of the most common Zerodha product codes discussed in this article.

- LMT: Used to place a limit order.

- MKT: Used to place a market order.

- Stop Loss (SL): This is used to place a stop loss on the limit price.

- MIS to Zerodha: MIS stands for Margin Intraday square offWhat is the meaning of Square Off in trading? In trading ter... More.

- CNC: It means cash n carry. CNC is for delivery-based trades.

Frequently Asked Questions

What are CNC and MIS in Zerodha?

CNC stands for Cash and Carry, which means you are placing this as a delivery order. At the end of the day, bought shares will be marked for delivery to your Demat account.

MIS stands for Margin Intraday Square OffWhat is the meaning of Square Off in trading? In trading ter... More. All open positions under the MIS product type will get automatically squared off if they are not closed before the auto-square-off time. This order type is used for intraday trading and also to get more margin for intraday trading.