While Demat and trading are very different in nature, the two can be easily opened with a minimum of fuss and just a few steps. The Demat account is a brokerage account, where you can buy and sell stocks, shares, and mutual funds. The trading account differs in that you can buy and sell stocks, shares, and mutual funds, but you also have the option to trade-in options, futures, and other contracts. In this guide, I will show you how to open both demat and trading account in SBI properly.

While you can open an SBI Demat and Trading Account on your own, there are certain steps that you should take before doing so. For example, it is advisable to have an SBI account before you open a Demat account since it will be easier to get the money transferred from your existing SBI account based on your SBI account number

A concise guide to opening a securities account and a business account with SBI (SBI Cap / SBI Smart): Over the past few months, I have received many emails asking how to transact with an account at the State Bank of India (SBI). In this post, I will explain the complete procedure to open your Demat and trading account with SBI in a simple way.

First of all, please note that you do not need to open a new SBI savings account if you already have an existing one. You can easily link your existing SBI savings account to your Demat and Trading account. However, if you do not have an SBI savings account, you can open a 3-in-1 account i.e. savings account + Demat account + business account. All three accounts are linked here.

How to Open a Demat and Trading Account in SBI

Documents required

To open a securities account and a business account with SBI, photocopies of the following documents are required:

- PAN Card

- Aadhar card (for address confirmation)

- A passport photo

- Identification of an existing SBI savings account (optional)

If you remember your SBI account number and the corresponding IFSC code, a photocopy of your SBI savings account card is not necessary. All you have to do is fill in your savings account details on the account opening form. However, it’s a good idea to keep a photocopy of it, just in case.

Direct debits from SBI Demat & Trading

Here are the different rates applicable to Demat and trading accounts with SBI. This information can be found on the SBI smart website under Charging in the Quick Access section – https://www.sbismart.com/customer-service.

SBI Demat & Trading account opening costs

You can choose from different plans when opening Demat and trading accounts with SBI. However, most beginners opt for a basic plan.

The basic fee for opening a securities and brokerage account with SBI is Rs Rs 850 plus GST charges. The VAT levied on this amount is 18% on the opening cost of the account i.e. 18% of Rs 850 = Rs 153. So the total amount to open an account is Rs 850 + Rs 153 = Rs Rs 1,003.

Also, this amount will be directly debited from your SBI savings account to which you will link your Demat and trading account. Therefore, no advance payment is required.

A quick tip: After you open a Demat account with SBI, you also have to pay an annual maintenance fee (AMC) of ₹500 per annum to the bank.

Current cashback plan

However, under the basic plan, SBI also offers a rebate of up to Rs lakh 650 on the brokerage fee if you invest/trade within the first 6 months of opening the trading account and trading account.

For example, suppose you have purchased ITC shares worth Rs. 50,000 within 6 months of opening the account. The brokerage fee for these investments is 0.5% of your investment (if you invest in delivery, i.e. if you hold the shares for more than one day).

Here the brokerage is 0.5% of Rs 50,000 = Rs 250. SBI will refund Rs 250 to your savings account.

Since the total cashback is Rs 650, we can say that the effective opening cost of the account (Rs 1,003 – Rs 650), is about Rs 350, including GST charges.

Also read : Explanation of the various costs of exchange transactions – brokerage, STT and others.

In addition, there are several other plans for opening an account that you can discuss with your local SBI account manager. Different plans have different cashback options, annual service rates, etc.

How do I open a securities account with SBI?

SBI Smart Site: https://www.sbismart.com

There are 3 ways to open a Demat account and an SBI trading account as shown below:

- Visit your local SBI office and open an account there.

- Complete the online application form available on the SBI website.

- Contact customer support and they will help you open your deposit and trading account.

– Method 1: Visit of the SBI agency

The first method is quite effective, although a bit complicated if your local SBI agency is far from your home. However, if you have the ability to go to an agency, you can easily handle all the paperwork in one day. In addition, the bank representatives present can answer all your questions about brokerage fees, annual percentage rate (AMC) fees, etc.

– Method 2: SBIOnline Demat Account Opening Process

The second way is good for the younger generation. You can easily fill in documents and upload them online. If you want to access your trading account and trading account on the SBI website, here is the link: https://www.sbismart.com/customer-service.

– Method 3*: Request for home visit by SBI liaison officer

The third way is the best and the easiest. To open a brokerage account and a trading account, you need to follow a few simple steps. Here they are:

- Visit the Contact page on the SBI Smart website: https://www.sbismart.com/contact-us.

- Fill out the contact form or call the toll-free number and provide your information. You will be asked for your name, city, zip code and phone number.

- An SBI customer service representative in your city will call you within 2 business days to walk you through the process.

OPINION: You can complete the contact form by going to the CUSTOMER SERVICE tab and clicking on the OPEN ACCOUNT option on the right hand side of the screen.

Alternatively, you can call SBI’s customer care team at 1800-209-9345 and provide your details.

Call a local customer service representative

When a customer service representative from your city calls you, you can also ask them to meet you at your address with a form to open an account. Usually they will come to the location of your choice to sign the account opening form and collect the documents (photocopy of PAN card, Aadhar card and a passport size photograph).

After submitting your account opening form, your account will be activated within 15 days. You will receive an email from SBI smart with your username and password and instructions on how to invest/trade with SBI smart.

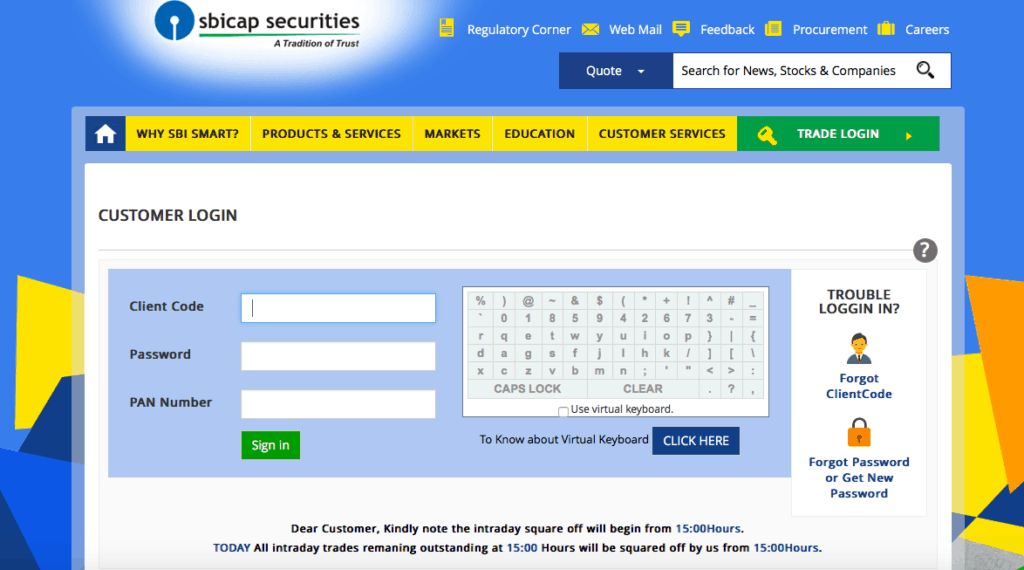

Once you have received your login details, you can start trading by visiting the SBI Smart website (https://www.sbismart.com) and selecting Login to Trade from the drop-down menu. Enter your login details and start trading.

Also read: How do I buy shares through the SBI-Demat account?

Final thoughts

SBI Demat and Trading account offered by SBI Cap is a trusted brand and subsidiary of State Bank of India, India’s largest bank. Since most Indians have a savings account with SBI, they may prefer to open a demat account and a trading account with SBI. Moreover, the process of opening an account with SBI cap is similar to that of any other broker you would want to open an account with. You need to fill the application form (online or offline) and provide the documents (Pan card, Aadhar card and bank details).

That’s it. It’s easy, right? Go ahead and open your Demat account and your SBI business account. I hope this article on opening a Demat account and an SBI trading account will be helpful to readers. If you have other concerns, please comment below. I’d like to help you. Have fun investing!

Frequently Asked Questions

Can SBI demat account be opened online?

Yes, SBI Demat account can be opened online.

How long does it take to open a demat account in SBI?

It takes around 2-3 working days to open a demat account in SBI.