What is MIS OrderWhat is MIS Order The full form of MIS order is Margin Intra... More

The full form of MIS orderWhat is MIS Order The full form of MIS order is Margin Intra... More is Margin Intraday Square up Order. This means, that every order under this type needs to be squared off on the same trading day.

If the order is not squared off by the client, then the RMS team or system of the broker will square offWhat is the meaning of Square Off in trading? In trading ter... More the position at the cut-off time. Every broker as predefined cut-off time, a few minutes before the market closing time.

Why MIS orders are used

There are two main reasons for using MIS orders:

Intraday Trading

When you are trading in any position for intraday and don’t want to carry that position, then MIS orderWhat is MIS Order The full form of MIS order is Margin Intra... More is used. The automatic square-off of the positions prevents the accidental carrying of the position overnight.

Higher Margin

Because positions are for the same trading day, brokers allow lower margins to be used to taking positions. You can visit your broker’s page to see the intraday margins.

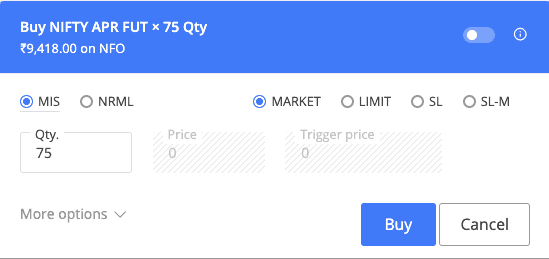

For example, to carry 1 lot of Nifty future the margin is approx ₹ 89,000 ( April 2020), whereas for MIS orders it’s around ₹ 20,000. Which is around 4.5 times less.

This allows traders with less trading capital to take more positions.

Points to be careful about

The compulsory square-off

You need to be especially careful about MIS orders when you change your mind about carrying a trade position. For example, if the stock breakout of a pattern, and you want to stay in those positions for higher profit, then you should remember to convert your MIS position to Normal. Else, your trade position will be squared off at the cut-off time.

Higher Risk

Due to lower margin requirements for intraday order, most of the times traders take unnecessary risk. Especially, when they have a feeling that the trade is going to be a winner. This is one of the biggest risks with MIS orders.

How to check the margin requirement for MIS order

As mentioned the margin requirement for an MIS orderWhat is MIS Order The full form of MIS order is Margin Intra... More is less than normal order, you can actually check the margin requirement on your broker’s website.

Every good broker has a daily updated sheet on their website with daily updated margin requirements. Simply search Google with search term – “Broker name margin calculator”.

How to convert a Normal position to MIS order & vice versa?

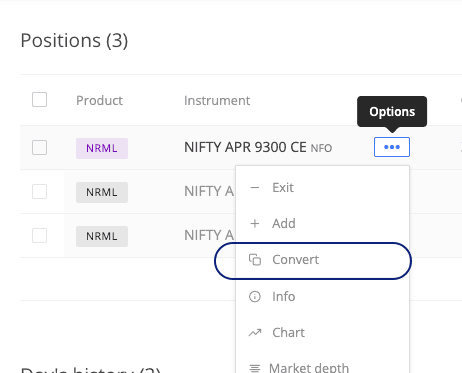

The procedure to convert any normal position to MIS orderWhat is MIS Order The full form of MIS order is Margin Intra... More or to convert an MIS position to a normal position is similar in all the brokers.

Here for this example, I am using Zerodha.

Just select the position that you want to convert and click the options menu:

Here you will see the convert option.

Click that and you will be able to convert.

If your trading account has a sufficient margin, then you will be able to convert your position from MIS orderWhat is MIS Order The full form of MIS order is Margin Intra... More to Normal. Otherwise, you will get a pop up about the shortage of amount.