FII and DII in the share market are the most common data you can see on business news channels, websites (NSE data) and newspapers. What do they really mean?

Understanding the importance of FIIs and DIIs in the Indian equity market: In the final months of the COVID19 pandemic and the stock market crisis, many news sources have talked about the liquidation of FIIs. In essence, FII refers to foreign institutional investors and DII refers to domestic institutional investors.

FII stands for Foreign Institutional Investors. In simple words, they can be defined as foreign companies, which have been incorporated in other countries (the country of incorporation) and have been authorized by the state of incorporation to conduct business in their own country. DII stands for Domestic Institutional Investors. DII means foreign companies which have been incorporated in India and have been authorized by the state of incorporation to conduct business in India.

But what do terms like FII and DII mean? And why are they important enough in the stock market to make headlines? In this article, we will discuss this. Here we explain what FII and DII are and why they are important. Let’s get started.

Different types of investors in the market

Individual investors, like you and me, who invest in their personal opportunities are called retail investors. But retail investors represent only a tiny fraction of the stock market. Institutional investors dominate the core business.

Institutional investors include hedge funds, insurance companies, pension funds, investment banks and mutual funds. They invest in various markets using pooled funds from purchased insurance, SIP investments, etc. from clients. These institutional investors are also known as market elephants because of their monetary power to influence the markets. It has also been observed that equity markets show an upward trend when institutional investors buy and a downward trend when they start to sell.

These institutional investors are further divided into foreign institutional investors [FIIs] and domestic institutional investors [DIIs], depending on whether the domestic or foreign institutions invest in the Indian financial markets.

Why do institutions invest in foreign markets?

FIIs tend to invest in emerging markets like India because investing in developing countries gives them more room for growth, which is limited in developed countries. This is done through a global investment fund, hedge fund, etc. that has a presence in their home country.

But the economic situation in emerging markets is not the only thing FIIs take into account when investing. The legal aspects and political climate of the country are also taken into account. This ensures the safety of the investments, as they already face the risks associated with investing in emerging markets.

Countries with flexible foreign investment legislation and a stable political climate top the list of attractive investment destinations for foreign investors. On the other hand, protectionist local laws and politically unstable countries are not popular with FIIs. For example, Prime Minister Modi’s victory was followed by a foreign portfolio investment of Rs 82,575 billion (the highest in the Modi era). The opposite happened when COVID-19 was declared a pandemic by the WHO.

However, FIIs also help the economy in which they invest. This is because they bring a huge amount of capital with them and stimulate economic growth in countries where capital is limited. The FIIs also help improve the country’s current account deficit. Interest from FIIs or positive net inflows is, therefore, a good sign. FDI outflows, on the other hand, indicate a country where investments have become too risky or are a sign of an unstable government.

The interests of FIIs change immediately depending on the economic and political climate. For this reason, FII investments are known as hot money.

DII or FII investments provide independent power. So why is this distinction necessary?

We have already noted the volatility of FIIs. Such volatility, combined with huge capital reserves, could have a detrimental effect on the economy in the event of a crisis.

FIIs have become a major driver in Indian markets. However, FII investments can be withdrawn at any time and in the past, they have been accused of causing large capital outflows, with significant negative consequences for domestic markets. To avoid a scenario where 100% of the company’s investment is in FIIs, a sale of FIIs would result in a sharp decline in the share price. This has led to laws limiting ownership to control the influence of FIIs.

How do you know where the big market players are investing?

What are the rules for FIIs?

Under the SEBI (Foreign Institutional Investors) Regulations -1995, FIIs are generally not allowed to invest more than 24% of the paid-up capital of the Indian company receiving the investment. However, FIIs can invest up to 30% if approved by shareholders.

LTCG and the importance of an enabling environment

DII refers to institutions that invest in the countries where they are domiciled. It is very important to note that the political and legal environment of a country plays a crucial role. The government offers financial incentives, such as. B. Business tax cuts, tax exemptions, subsidies and other financial incentives. This creates a favourable environment for investment. In such a scenario, not only the FIIs are interested but also the DIIs are encouraged to continue investing in India rather than seeking opportunities elsewhere.

In 2015, dividends and long-term capital gains (LTCG) from publicly traded stocks are fully exempt from income tax, even if they are not earned by the poor. These measures encourage institutional investors to raise capital in India. But in 2018, the opposite happened when the then Finance Minister Arun Jaitely announced a long-term capital increase of 10% in the Budget, upsetting market sentiment. This led to a relentless sell-off of shares held by FIIs and DIIs in February 2018.

These investments were focused on Brazil and Gabon, where they benefited from appropriate remuneration conditions, namely a 100% income tax exemption and long-term capital gains. Therefore, it is also very important for the government to create an investment climate conducive to raising capital in India.

How do I know what is FII and DII holding in my shares?

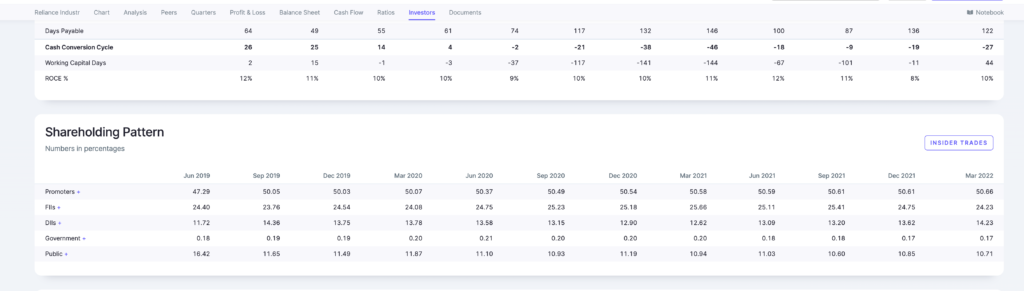

To find out the shareholding of FIIs and DIIs in a particular stock, please visit the Shareholder Structure segment of the portal. Just go to https://www.screener.in and search for the company name in the search bar. This will take you to the stock information page. Go to the Shareholding Structure section on this page.

Here, for example, you can see the most recent RELIANCE INDUSTRIES shareholder structure (broken down by quarter). With the help of this detailed table, you can know the FII and DII ratio of Reliance Industries for different quarters.

(Image: shareholding Reliance Industries)

You can also check the shareholding of FIIs and DIIs in a listed company in India by viewing the shareholding pattern.

Final thoughts

In this article, we have discussed what FIIs and DIIs are in the stock market, how they differ and how you can find out the details of their ownership.

In essence, FII refers to foreign institutional investors and DII refers to domestic institutional investors. By looking at the share of FIIs and DIIs in various stocks, you can determine how much confidence major investors have in specific stocks, industry segments, and the market as a whole.

Frequently Asked Questions

Who is DII in the stock market?

DII stands for Domestic Institutional Investor. They pool money under a scheme and then invest in their domestic stock market. In India, DIIs are mutual funds, insurance companies, banks and financial institutions, and NPS and provident funds.

Who comes under DII?

In India, Mutual Funds, Insurance Companies, Bank & Financial Institutions, NPS and Provident Funds come under the definition of DII.

What is the meaning of FII in the share market?

FII stands for foreign institutional investor.