There are three important concepts that should be discussed in this article. Face Value is the price that investors pay for a stock when they purchase it. Market Value is the price that investors receive when they sell their shares. Book Value is the value of a specific company’s assets, including cash, inventory, and receivables, minus the value of its liabilities.

The purpose of this blog is to help anyone interested in buying/selling stocks, bonds, commodities and other financial instruments to learn the basics of finance. So many things related to this topic including watching the news, investments, futures and how stocks, bonds, commodities and other financial instruments/investments are traded.

Overview of face, market and book value: Recently, while perusing my profile on Quora, I received a request for an answer to the question of what is the difference between the face value and the market value of a company. While these are basic stock terms, they can be a bit confusing for newcomers. So I decided to write a simple blog explaining the difference.

In this article, we will discuss the difference between the face value, the market value and the book value of shares. Let’s start with the easy part.

Difference between nominal value, market value and book value

Market value

The market value per share is the current value of the share. This is the price at which the market values the stock. For example, if a stock is trading at Rs. 100, then this is the market value per share of that company. The market value per share of a company fluctuates constantly during the trading period.

In addition, the total market value of a company, also known as the market capitalization of a publicly-traded company, is calculated by multiplying the company’s current stock price by the total number of shares outstanding.

Face value

The face value is the nominal value of a company as shown in its books and share certificate. The Company determines the face value of the shares at the time of issue. The face value of the share is fixed (until the company decides to implement or reverse the share split).

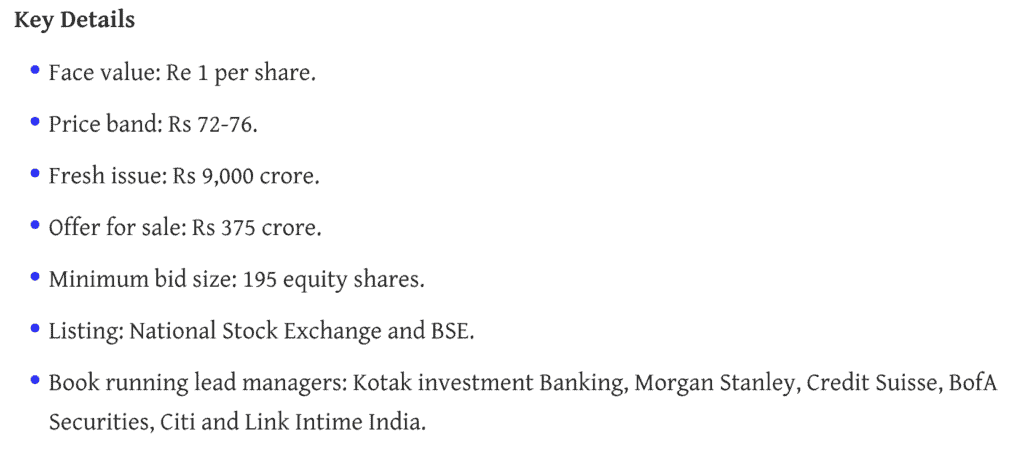

For example, in the IPO of Zomato, the management opted for a face value per share of Rs 1. Here are the details:

(Source: Zomato IPO details| Bloomberg Quint)

Generally, the face value of the company is lower than the market value. For example, when a company goes public, it may have a face value of Rs 10. And its shares can be traded at a market price of Rs 500.

However, this is not always the case. For example, in the case of penny stocks, the face value of a company may be higher than its market value. Penny stocks are companies whose share price is less than Rs 10 lakh. So here the market price may be 5 lakhs and the face value of the company may be 10 lakhs.

Moreover, the nominal value of the company does not depend on the increase or decrease of its stock price. On the other hand, a stock split would reduce the nominal value of the company. For example, if the current face value of the company is Rs. 10 lakhs and it announces a one-for-one share split. The nominal value of this company shall then be distributed in the same proportion. Here, the face value will change by Rs 5 lakh as the total number of shares will double after the share split.

Book value

In simple terms, the book value of a company theoretically means the total value of the company’s assets that the shareholders would receive if the company were to be liquidated, i.e. if all of the company’s assets were sold and all liabilities were paid to all debtors. Therefore, the book value can be considered as the net worth of a company as it appears in its books.

The book value is calculated as the sum of the assets minus the intangible assets (patents, goodwill) and the liabilities. If you divide the book value of the company by the total number of shares outstanding, you get the book value per share.

You can compare a company’s book value per share with its market price to determine whether the company is undervalued or overvalued. Moreover, it is always advisable to invest in companies whose book value increases over time.

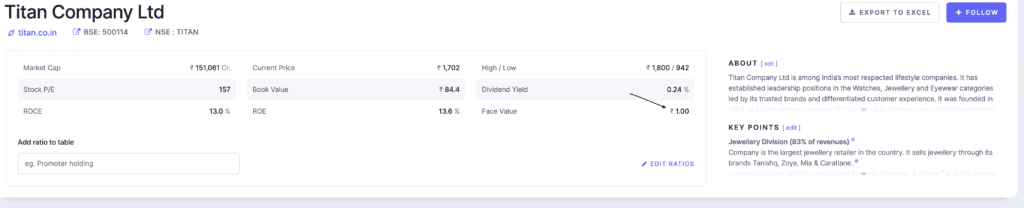

For example, here is the book value of TITAN :

(Source: Screener.in)

Where can I find these values?

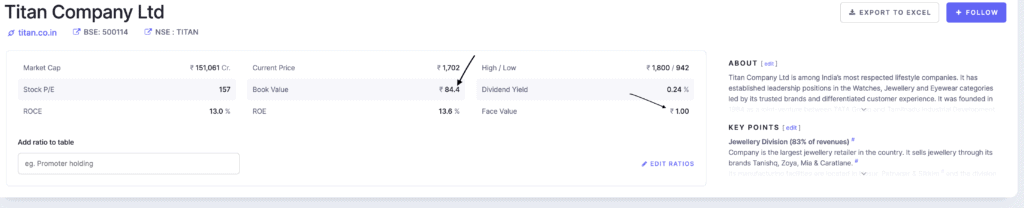

The face value, book value and market value of the company can be found on almost any financial website.

When you open a company page on a financial website, the first thing you see is the market value per share. However, with a little digging, you can easily determine the par value and book value per share of a company. For example, here are the par value, market value and book value per share for Asian Paints. (Source – Screener).

(Source: Screener)

Similarly, you can use the MoneyControl website to determine a company’s face value, market value, and book value:

(Source: Money Control)

Moreover, you can also find this information on other popular financial sites such as Yahoo Finance, Marketsmojo, Equitymaster, etc.

Final thoughts

The meaning of nominal value, market value and book value should now be clear to you. These three terms are all different and should not be confused when looking for a company.

The market value per share is the current value at which the share is traded on the market. The nominal value is the value of the company as stated in the company’s books and in the share certificate. Finally, the book value of the company is the total value of the company’s assets that the shareholders would receive if the company were to be liquidated.

So much for this post. I hope this was helpful. Have fun investing!!!

Frequently Asked Questions

Is face value and market value the same?

No. Market value is the price that security is currently trading at. Whereas the face value is the nominal price of the share set by the company.

What is the difference between a stock and a bond?

A stock represents ownership in a company. A bond is a loan that is repaid with interest.